The Lynas Rare Earths Ltd (ASX: LYC) share price is surging today.

Shares in the S&P/ASX 200 Index (ASX: XJO) rare earths miner closed yesterday trading for $6.82. At the time of writing on Wednesday morning, shares are swapping hands for $7.15, up 4.9%.

For some context, the ASX 200 is up 0.6% at this same time.

Here's what investors are considering today.

What did the ASX 200 miner report?

The Lynas share price is leaping higher after the miner reported late yesterday that its wholly owned subsidiary, Lynas Malaysia, was issued a variation to its operating licence.

Lynas will now be allowed to keep importing and processing Lanthanide Concentrate, sourced from its Mt Weld mine in Western Australia, at its Malaysia facility. The newly amended operating licence runs through 2 March 2026.

Just last week, Lynas noted that its legal issues with the Malaysian government over those importation rights were ongoing.

Now the miner said that under the new operating licence, it will increase its existing research and development (R&D) investment in Malaysia from 0.5% to 1% of Lynas Malaysia's gross sales.

Lynas reported it will also proceed with capital works as planned to expand the downstream separation capacity at the facility to approximately 10,500 tonnes per annum of NdPr.

Following on the release of the announcement in late afternoon trade yesterday, the Lynas share price leapt 13% in a matter of minutes to close flat on what had been looking to be a day of steep losses.

"As the leading producer of rare earths outside of China, Malaysia plays an important role in the global rare earths supply chain," Lynas CEO Amanda Lacaze said. "This decision provides a strong foundation for further development of the Malaysian rare earths industry."

Lacaze added:

Lynas deeply values our people and communities in Malaysia who recognise that Lynas Malaysia is an excellent employer and a safe and responsible community member, as demonstrated by our over 10 years of safe operation…

We look forward to continuing to contribute to the development of the rare earths industry in Malaysia.

Lynas share price snapshot

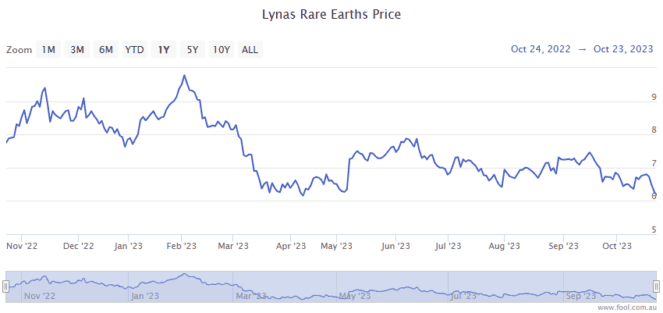

With a big late afternoon gain yesterday and more gains this morning, the Lynas share price is now only down 7% in 2023.