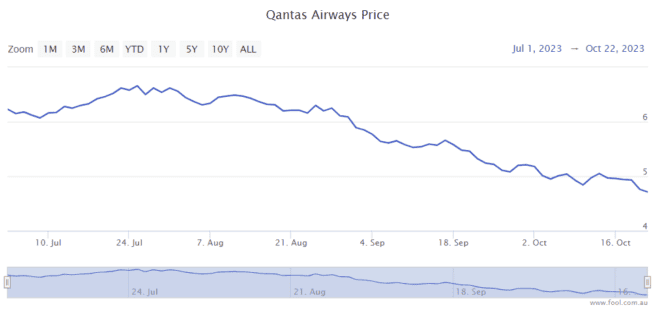

The Qantas Airways Limited (ASX: QAN) share price has had a terrible run in recent times, down by around 30% in the past three months. We can see on the chart below how it has nosedived.

When the share price of a blue chip falls heavily, it's worth asking whether the company is an investment opportunity. Look at what happened to companies during the COVID-19 crash and also in 2022 – many of them bounced back strongly. So, is the Qantas share price a buy right now?

The airline is under pressure

There are a number of things hurting the airline.

Rising oil prices could be a problem for profitability because the cost of fueling planes is increased.

Qantas is facing ACCC scrutiny in relation to tickets sold for thousands of cancelled flights, as well as other issues.

The airline is also hurting from the court decision that ruled it illegally sacked more than 1,700 workers during COVID-19.

Plus, there has been a furore about Qatar Airways being denied more flights into Australia.

Is the Qantas share price a buy?

Analysts seem to be largely excited by the value that the ASX travel share is now trading at. According to the ratings collated by Factset, there are 11 buy ratings, three holds and one sell on Qantas shares.

Remember, those ratings aren't a judgment of whether Qantas has done right or wrong. It's looking at the Qantas share price and suggesting that it has fallen enough to be a good opportunity.

The broker UBS currently has a buy rating on the business.

UBS has noted that Qantas will incur an extra $80 million of costs in FY24 as it aims to address "sources of recent customer frustration", such as additional seats available for points redemption, improved catering, improved call centre support and more "generous" policies to help customers through service disruptions. UBS believes half of those costs are recurring in nature.

Despite those extra costs, UBS believes conditions will support FY24 earnings per share (EPS) similar to that of FY23. The broker suggests that Qantas could generate EPS of 95 cents in FY24, 97 cents in FY25 and $1.01 in FY26.

If it were able to make 95 cents of EPS, that'd put the current Qantas share price on a forward price/earnings (P/E) ratio of 5x. UBS thinks the market is pricing in the risk of a material earnings 'correction'.

UBS suggests that if the airline is able to deliver on its forecasts, with more capital returns (through share buybacks and dividends), then it should prove "resilient, resolve concerns and drive re-rating".

I think we're getting to the stage where the Qantas share price is a longer-term contrarian opportunity. I believe that it's at times when the outlook seems bleak for a company that we can find some of the best buying opportunities. But I'm not expecting it to be a quick turnaround for Qantas over the next month or two.