There are some wonderful S&P/ASX 300 Index (ASX: XKO) shares that look like great buys, in my opinion. After recent declines, they seem really cheap.

A company isn't necessarily a buy just because it has fallen. However, if an ASX share has an attractive long-term future, then a share price fall can be an opportunity to buy the dip.

One bonus is that when a dividend-paying company drops, it increases the prospective dividend yield. I'm thinking about adding one or both of these ASX 300 shares to my portfolio. Let's dive into the details.

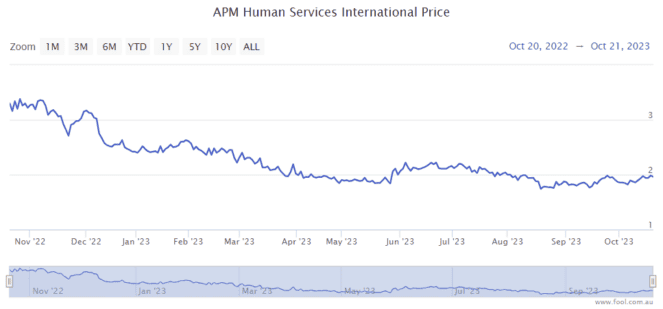

APM Human Services International Ltd (ASX: APM)

Over the past year, the APM share price has declined by around 40%, as we can see in the chart below.

This company operates in 11 countries, including Australia, the United Kingdom, Canada, the United States and Germany.

Each year, it supports more than 2 million people of all ages through its service offerings. They include assessments, allied health and psychological intervention, medical, psycho-social and vocational rehabilitation, vocational training and employment assistance, and community-based support services.

APM Human Services had a solid year in FY23, with underlying net profit after tax (NPATA) growing by 7%. Total profit from ordinary activities soared 166.8% to $108.7 million. The dividend doubled to 10 cents per share.

It's gaining market share and advised it has a strong pipeline of new opportunities. The ASX 300 share won a number of new contracts in FY23, so the full revenue and earnings from these will flow through in FY24. No key contracts are due for renewal in FY24 or FY25.

According to Commsec, it's priced at under 10x FY24's estimated earnings with a forecast grossed-up dividend yield of 7.5%.

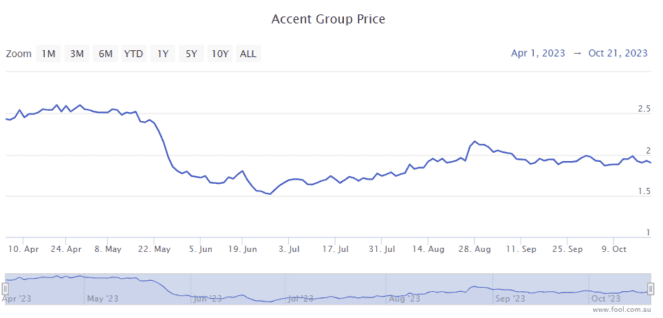

Accent Group Ltd (ASX: AX1)

Accent Group is an ASX retail share that sells shoes. It has its own brands including The Athlete's Foot and Glue Store, and it also acts as the distributor for a number of brands like Skechers, Kappa and Vans.

As we can see on the chart below, the Accent share price is down around 30% from April 2023.

It's understandable that investor sentiment about the company changes as trading conditions shift over time. But, I'm confident in Accent's long-term outlook, partly because it's expanding the store networks of the various brands and partly because I think there are better times ahead for retailers when Australian economic conditions improve, even if that's a year or two away.

The ASX 300 share has done well at growing its margins over time, with increased scale helping substantially.

Based on the FY25 projections on Commsec, the Accent share price is valued at 11x FY25's estimated earnings with a forecast grossed-up dividend yield of 10.9%.