While we pigeon-hole certain ASX shares as "cyclical", the reality is that most companies go through periods of high and low demand for their products and services.

So when some cheap shares are spotted, if you can look past this cyclicality some absolute bargains could be picked up.

The analysts at Auscap reckon they have one such unloved stock that's ripe for adding to portfolios right now:

Frustrating to own, even for long-term investors

Reliance Worldwide Corporation Ltd (ASX: RWC) is a plumbing parts maker that's had a tough time on the ASX since listing in 2016.

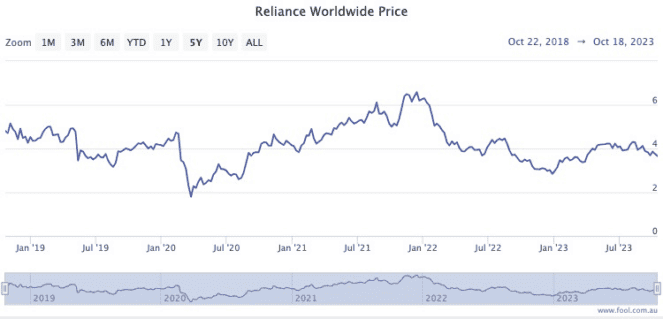

The stock is now trading only 20% higher than its first day closing price. Over the past five years it's actually lost investors 26.5%.

That's despite it selling a pretty unique product called SharkBite, which allows pipes to be push-connected behind walls without soldering, clamps, rings or even tools.

Auscap analysts, in a memo to clients, suggest the product isn't the problem.

"Investors have since questioned RWC's significant customer concentration, with Home Depot Inc (NYSE: HD) representing a very large share of revenue at IPO, lack of SharkBite patent protection, perceived cyclicality, and exposure to input commodity cost pressures, particularly brass."

Seeking to solve problems

Perhaps in acknowledgement that these are legitimate criticisms, the Auscap team points out Reliance Worldwide has sought to remedy all those issues.

Its customer base is diversifying, although Home Depot and Lowe's Companies Inc (NYSE: LOW) still remain significant clients.

"Earlier this year, RWC also announced the launch of its new SharkBite Max, a higher quality fitting with patent protection, premium pricing, 20% less brass content than the first generation SharkBite and product assembly located much closer to its major US customers."

That shift in manufacturing from Australia to the US has understandably been "a considerable operational undertaking".

Auscap analysts recently visited the new assembly factory in Cullman, Alabama.

"We came away viewing the initiative as tracking to plan, whilst being impressed by RWC's automation and operational leverage opportunities as the manufacturing process of the SharkBite Max product continues to move to the United States."

Cheap shares that could explode in the coming period

All this means that Auscap analysts are convinced the market has gone too far in punishing Reliance Worldwide, with much upside in years to come.

"RWC's latest guidance is for revenues to be down by a low single digit percentage in FY24 and for margins to be stable.

"Should this occur it would be a decent result in a difficult market and due in part to RWC's defensive repair and renovation exposure and the margin benefits from the recent management initiatives discussed above."

Reliance shares are currently trading on a price-to-earnings (P/E) ratio of around 12.5, which the Auscap experts say is "significantly below many domestic and international peers".

And despite the disappointing share price performance since its 2016 listing, the cold hard fact is that the company has "tripled earnings per share since listing".

"The group should benefit from any cyclical recovery in its end markets," read the memo.

"The long-term incentives of RWC's CEO require compound earnings per share growth of 4% to 15% over the next three years to vest. We are positive over the medium term on our investment in RWC."