I love finding beaten-up ASX share opportunities that have dropped in price, making them better value in my eyes.

Just because something has fallen doesn't automatically make it a good option. But, I think the longer-term outlook for the below three beaten-up ASX shares looks promising.

Elders Ltd (ASX: ELD)

The Elders share price has fallen by over 50% in less than a year, as we can see on the chart above. It's close to five-year lows, so it's rare for the company to drop as far as it has.

I'm not a farmer, but it seems common for agricultural businesses to go through longer-term cycles. Sometimes weather helps the business and sometimes it's a hindrance. There will be periods of strong demand and also times of weakness. I believe the periods of weakness are a good time to consider investing in the company.

For people that don't know this business, it says it works closely with primary producers to provide products, marketing options and specialist technical advice across rural, wholesale, agency and financial product and service categories. It's also an Australian rural and residential property agency and management network. The company's feed and processing business segment has a "top-tier" beef cattle feedlot in New South Wales.

The beaten-up ASX share recently reported it's suffering from cautious customer sentiment in light of "uncertain seasonal conditions in some farming regions", with a heightened probability of warmer and drier average conditions due to El Nino.

The business faces an uncertain next year or two, but I think the longer-term makes me positive this is a contrarian opportunity to consider.

I also like that the business continues to make acquisitions, growing and diversifying its earnings.

According to the estimate on Commsec, the business is valued at 9 times FY25's estimated earnings, with a possible grossed-up dividend yield of close to 6.8% for FY25.

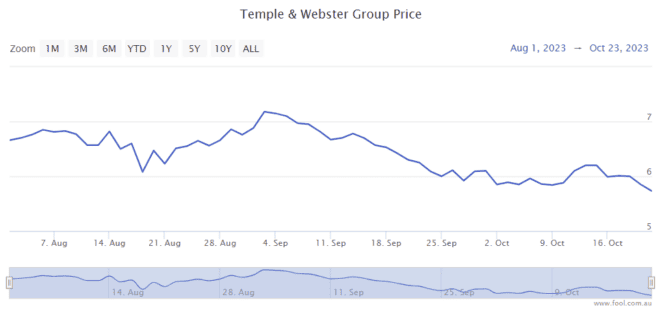

Temple & Webster Group Ltd (ASX: TPW)

The Temple & Webster share price is down 23% since the end of August, as seen on the chart above.

This company is the largest pure-play online retailer of homewares and furniture in Australia.

The beaten-up ASX share has over 200,000 products for sale on its website from hundreds of suppliers – those suppliers send the products directly, enabling the company to have a capital-light model and not need to hold as much inventory. It has its own private label range as well.

I think there is a long-term tailwind of more people doing online shopping more frequently.

As an online operator, there are significant benefits for the company if it continues to see more sales. Growth can help it deliver economies of scale, including lowering its fixed costs as a percentage of revenue, which would boost margins.

It's also looking to utilise AI more throughout the business to serve customers in various ways, including with an AI interior design service.

Revenue in the first month and a half of FY24 had grown by 16% thanks to growth in both repeat and first-time customers. I think this bodes well for FY24 and beyond, and I'm considering using the decline of the beaten-up ASX share as a time to invest.

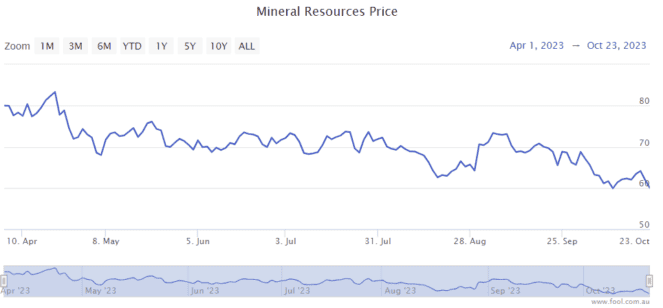

Mineral Resources Ltd (ASX: MIN)

The Mineral Resources share price has dropped 17% in a month and around 30% in the past six months, as we can see on the chart above.

This is an interesting business – it's an iron ore miner, a lithium miner, it offers mining services and it also has an emerging energy division.

The iron ore price remains above US$110 per tonne, so the short-term outlook for iron ore earnings looks positive.

Lithium prices have sunk in the last few months, but the long-term lithium demand looks positive with a large projected rise in the number of electric vehicles.

I like that the business is looking to expand both its iron and lithium operations, which can help it deliver longer-term earnings.

According to the projection on Commsec, the Mineral Resources share price is valued at under 11 times FY25's estimated earnings, with a possible grossed-up dividend yield of 3.5%.