With inflation still running hot, and bank deposit rates trailing loan rates, the passive income offered by leading S&P/ASX 200 Index (ASX: XJO) retail shares is in our crosshairs today.

Below we look at two quality retail stocks paying fully franked dividends, offering some potential benefits come tax time. And both ASX 200 retail shares trade at inflation-busting yields of more than 7%.

Before the big reveal, do note that the yields you generally see quoted – and those we discuss below– are trailing yields. Future yields may be higher or lower, depending on a range of company-specific and wider macroeconomic factors.

With that said…

Two ASX 200 retail shares paying market-beating passive income

Up first we have consumer electronics and home appliance retailer, JB Hi-Fi Ltd (ASX: JBH).

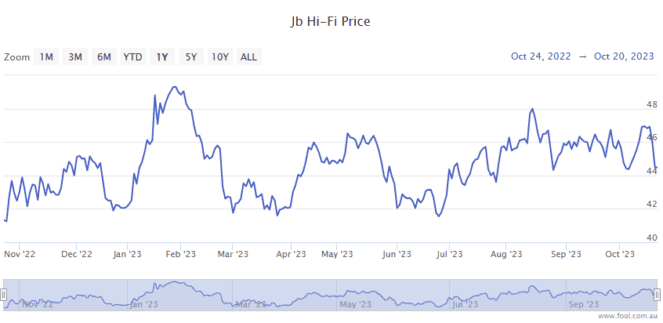

The JB Hi-Fi share price has been resilient in the face of rising interest rates and sticky inflation. Shares are up 7% over the past 12 months, closing on Monday trading for $44.36 per share.

On the passive income front, the ASX 200 retail share paid an all-time high interim dividend of $1.97 per share on 10 March. The final dividend of $1.15 per share was paid on 8 September.

All up then, JB Hi-Fi shares delivered $3.12 per share in dividends over the past 12 months. At yesterday's closing price, that equates to a fully franked yield of just over 7%.

Which brings us to home furnishings and white goods retailer Harvey Norman Holdings Ltd (ASX: HVN).

Unlike JB-Hi Fi, Harvey Norman has struggled with falling revenue (down 3.8% in FY 2023 to $9.2 billion) and slumping profits (NPAT down 33.5% in FY 2023 to $540 million).

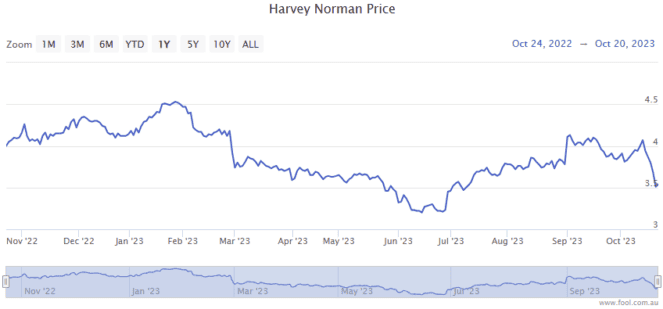

This has in turn pressured the Harvey Norman share price, down 12% over the past months. Shares closed on Monday trading for $3.55 apiece.

But the worst pain may be over for this ASX 200 retail, with management stating the company is "well-placed to benefit from any upturn in trading conditions and any growth that may arise from the home renovation cycle, new home starts and net migration increases".

As for the passive income we're hunting for, Harvey Norman shares delivered an interim dividend of 13 cents per share on 1 May. The final dividend of 12 cents per share will be paid on 13 November.

That works out to a full-year dividend payout of 25 cents per share.

At Monday's closing price, this ASX 200 retail share also trades at a fully franked yield of just over 7%.