New Hope Corporation Ltd (ASX: NHC) shares will soon go ex-dividend. So, investors wanting a piece of the action will need to be quick.

The ASX coal share recently reported its FY23 annual result, which included an announcement of its final dividend for the financial year.

The coal company declared a final fully franked ordinary dividend of 21 cents per share and a final fully franked special dividend of 9 cents per share. This brings the total to 30 cents per share.

New Hope shares are about to go ex-dividend

When a company goes ex-dividend, new investors are no longer entitled to that upcoming dividend payment.

The ex-dividend date is the day new investors miss out. So if someone wants to take advantage of the dividend, they need to invest before that date.

In this instance, the ex-dividend date for New Hope's upcoming dividend is 23 October. That's on Monday, meaning the last day to invest in the company for a slice of the payout is 20 October. Which is today!

This dividend will be paid on 7 November 2023, so investors won't have to wait long.

Dividend yield

The combined dividends equate to a grossed-up dividend yield of 6.7% from New Hope shares. But an investor shouldn't buy an asset just because of the income yield; the valuation needs to make sense as well.

Looking at the total full year fully franked dividends declared of 70 cents per share, that represents a grossed-up dividend yield of 15.6%.

The projection on Commsec suggests the dividend is going to be smaller in FY24, with a total annual payout of 41 cents per share, which would be a grossed-up dividend yield of 9.1%.

New Hope share price snapshot

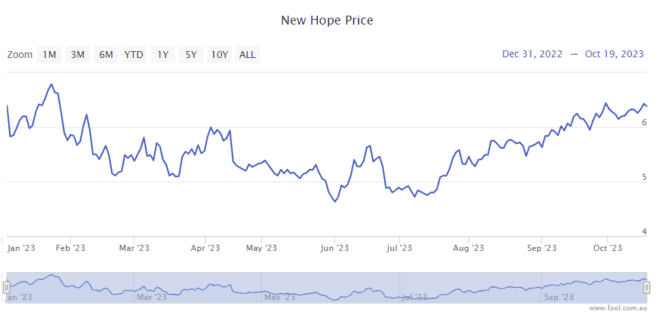

As we can see on the chart below, New Hope shares are up around 10% this year and more than 30% higher since 30 June 2023.

However, remember that past performance is not a reliable indicator of future performance, particularly given the volatility of a mining company.