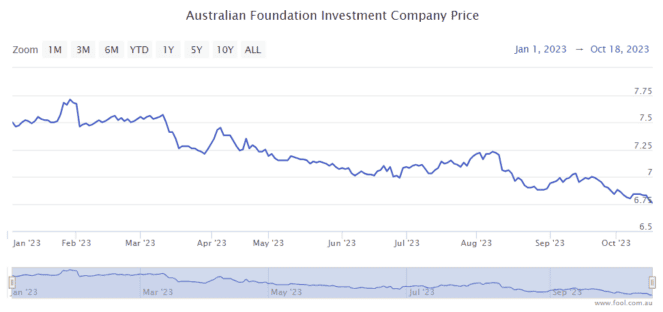

The Australian Foundation Investment Co Ltd (ASX: AFI), or AFIC, share price has been headed lower over 2023, as we can see on the chart below. Does this make it a buy opportunity?

For readers who don't know, AFIC is a listed investment company (LIC) that has been operating for around 100 years. Its job is to make returns for shareholders, which it predominately does by investing in ASX blue-chip shares.

It tends to pay investors a steady dividend, which may be attractive for people who want consistent passive income.

As a general point, I think AFIC is a worthy investment vehicle to get exposure to the ASX share market. I'm going to look at whether it's good value today.

Discount or premium?

A LIC's portfolio represents a basket of shares that has a value.

Every month, the company tells us about its net tangible asset (NTA) per share which is essentially the underlying value of each AFIC share.

At 30 September 2023, the AFIC pre-tax NTA was $6.97. The NTA changes every day as the share prices of the portfolio move each trading day. But, the latest monthly NTA is what investors have to utilise.

The current AFIC share price is $6.80, which is a 2.5% discount to that September NTA figure of $6.97.

AFIC shares traded at a sizeable premium to its NTA during COVID-19, but in the last few months, it has started to trade at a discount.

Looking at the AFIC chart of monthly NTA premiums or discounts, it hasn't reached a discount of 5% (or more) in the last decade, so this is close to the best it has been in terms of the NTA discount for the past ten years.

AFIC investment performance

The AFIC portfolio performance, being net asset per share growth plus dividends (including franking), has underperformed the S&P/ASX 200 Accumulation Index (ASX: XJOA) (including franking) in the short-term and long-term.

In the past year, AFIC's portfolio underperformed by 1%, while over the past ten years, it underperformed by an average of 0.8% per annum

However, the LIC notes that the AFIC portfolio return is also calculated after management fees, income tax and capital gains tax on realised sales of investments, while the index does not include management expenses or tax.

So, each investor will need to decide what is a fair comparison between AFIC and the index.

What we can see is that the AFIC share price is only up by around 12% over the past five years. It may not be the sort of investment that delivers strong capital growth because of the businesses it invests in and how it pays out a sizeable dividend every year.

Dividend yield

Over the last 12 months, owners of AFIC shares have received 25 cents per share.

That represents a cash dividend yield of 3.7% and a grossed-up dividend yield of 5.25%. Investors can get savings accounts that pay a similar amount now, so it's not as attractive as it used to be.

Foolish takeaway

I think AFIC is essentially the most attractive it has been. But I'm not expecting much capital growth because I don't think large positions in the portfolio like Commonwealth Bank of Australia (ASX: CBA), BHP Group Ltd (ASX: BHP) or Woodside Energy Group Ltd (ASX: WDS) can deliver a lot of capital growth because of how big they already are in their respective industries.

There are plenty of ASX shares that could achieve stronger long-term returns, but I think AFIC shares can still be a good long-term option for people who want simple investing.