The Woodside Energy Group Ltd (ASX: WDS) share price is outperforming today.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock closed yesterday trading for $36.09. In morning trade on Wednesday, shares are swapping hands for $36.37 apiece, up 0.8%.

For some context, the ASX 200 is up 0.1% at this same time.

This comes following the release of Woodside's third quarter activity report for the three months ending 30 September.

Read on for the highlights.

Woodside share price up on quarterly revenue boost

Investors are bidding up the Woodside share price today after the company reported an 8% quarter-on-quarter increase in production after completing planned turnaround and maintenance activities.

Over the three months, Woodside produced 47.8 million barrels of oil equivalent (MMboe), which equates to 520 Mboe per day.

Woodside CEO Meg O'Neill said strong operating results at its Pluto LNG site helped drive the production boost.

"The 99.9% reliability achieved at Pluto during the third quarter followed the completion of a maintenance turnaround in June," she said.

That higher production spurred a 10% increase in sales volume from the prior quarter to 53.3 MMboe.

Revenue for the quarter came in at $3.26 billion. That's up 6% from Q2 2023 despite a lower average realised price of $60.2/boe.

While up from the prior quarter, revenue was down 44% from Q3 2022. Year to date revenue is down 9% compared to the first three quarters of 2022 amid a retrace in energy prices.

The Woodside share price could also be getting a boost after the company highlighted it had achieved first production at its Shenzi North project in September, well ahead of its initial 2024 target.

What's next?

Looking at what could impact the Woodside share price in the months ahead, the company said its Sangomar project was 90% complete, with 14 of 23 wells drilled and completed. The floating production storage and offloading topsides integration and pre-commissioning works continued in Singapore.

The company's Trion field development plan was approved by the Mexican regulator, and that project is now moving into the execution phase.

As for the Scarborough and Pluto Train 2 project, this was reported to be 46% complete, with fabrication of the floating production unit (FPU) and Pluto Train 2 modules progressing.

However, that project remains under the cloud of the recent Federal Court ruling, which has delayed seismic surveying at the site.

"The Federal Court's 28 September decision that the Commonwealth Environment Plan for the Scarborough offshore seismic survey is invalid has not impacted our target for first LNG cargo in 2026," O'Neill said of that decision.

O'Neil continued:

The decision does however highlight the urgent need for reform of Australia's offshore approvals process. Uncertainty over approvals has the potential to add cost and delays to any offshore activities to be undertaken in Australia…

The importance of Scarborough to regional energy security was demonstrated in August when LNG Japan agreed to purchase a 10% non-participating interest in the joint venture.

Woodside also narrowed its full-year production guidance to a range of 183 to 188 MMboe.

Woodside share price snapshot

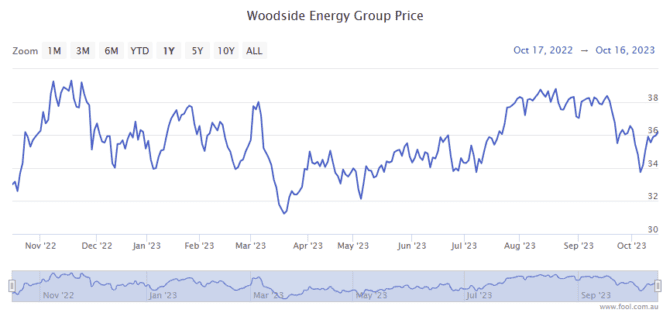

The Woodside share price is up 11% over the past 12 months.