Coles Group Ltd (ASX: COL) shares are often touted as an attractive ASX dividend share. It's understandable – the company usually has an attractive dividend yield and it has been steadily growing its dividend since it listed.

Coles dividend

In FY23, the company saw its continuing operations earnings per share (EPS) fall by 0.6% to 78.1 cents and the annual dividend per share was hiked 4.8% by the board to 66 cents per share. At the current Coles share price, that represents a trailing grossed-up dividend yield of 6.1%.

However, the dividend growth streak is currently predicted to end in FY24. The projection on Commsec is that owners of Coles shares will get an annual dividend per share of 61.4 cents in the current financial year, which would be a grossed-up dividend yield of 5.7%.

Is debt a problem?

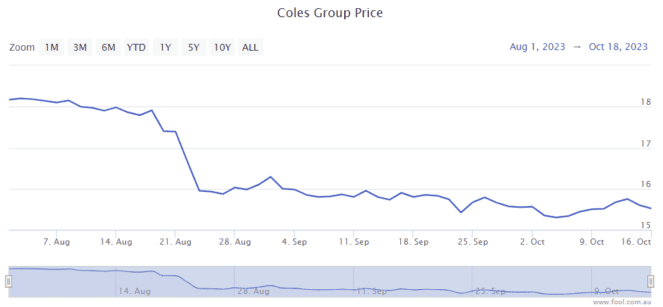

The last couple of months have been tough for the market capitalisation, with the Coles share price dropping by around 15% since 1 August 2023, as we can see on the chart below.

The company's total debt grew from $1.06 billion at 1 January 2023 to $1.12 billion at 25 June 2023. Net debt, excluding lease liabilities, was $521 million at the end of FY23, a $159 million increase from the half-year net debt position. An overloaded balance sheet could end up being problematic for Coles shares, though it's not at that stage.

At the financial year end, Coles' average maturity of drawn debt was five years and it had undrawn facilities of $2.3 billion.

In FY23, Coles said that its interest on debt and borrowings had increased by $12 million, from $16 million in FY22 to $28 million in FY23. Interest paid on the cash flow statement, excluding the lease payments portion, saw a $16 million rise to $57 million.

In the 2023 financial year, it generated continued operations net profit after tax (NPAT) of $1.04 billion, so the company has plenty of financial room to keep paying the current interest. However, if interest rates stay as high as they are (or go higher) then Coles' interest cost could keep increasing.

Coles said that its lease-adjusted leverage ratio at the full year was 2.6 times on a continuing operations basis. The leverage ratio is the gross debt minus cash at the bank and on deposit and add lease liabilities, divided by earnings before interest, tax, depreciation and amortisation (EBITDA).

It noted it had published credit ratings of BBB+ with Standard & Poors and Baa1 with Moody's.

Management believes that the company retains the headroom with its rating agency credit metrics and a "strong" balance sheet to support growth initiatives.

Will Coles debt increase?

In FY23, the company's debt increased and it noted operating capital expenditure of $1.36 billion. FY24 is expected to see operating capital expenditure of between $1.2 billion to $1.4 billion.

Coles recently announced that there would be delays for its Ocado distribution centres, increasing the project capital and operating expenditure by approximately $70 million and $50 million, respectively. Total capital expenditure is now expected to be approximately $400 million, of which 55% had been incurred by the end of FY23.

The company has also warned that short-term profitability may be hit by inflation costs, particularly relating to wages. This could lead to a fall in profit in FY24, according to the projection on Commsec. Lower profit could hurt the Coles share price.

If profit falls and capital costs are high, the supermarket business may decide to pay a smaller dividend. Taking on more new debt, with a high-interest cost, to pay a larger dividend could be counterproductive for long-term success.

However, Coles may be able to grow revenue at a good enough pace to offset that thanks to food inflation and an increasing population.