The All Ordinaries Index (ASX: XAO) is up a slender 0.04% during the Wednesday lunch hour, despite some heroic lifting by this ASX All Ords share.

The stock was up 22% in earlier trade and remains up 17.8% at the time of writing.

Any guesses?

If you said Southern Cross Media Group Ltd (ASX: SXL), go to the head of the virtual class.

The Southern Cross Media share price closed yesterday trading at 73 cents. Shares are currently swapping hands for 86 cents apiece.

Here's why the ASX All Ords share is rocketing higher today.

What's happening with Southern Cross Media shares?

Investors are bidding up the ASX All Ords share after the company announced it has received a non-binding indicative proposal from ARN Media Ltd (ASX: A1N) and Anchorage Capital Partners Pty Ltd to acquire 100% of its fully diluted share capital.

The proposal offers 29.6 cents in cash along with 0.753 ARN Media shares per Southern Cross Media share.

Based on Tuesday's closing price of 85.5 cents per ARN share, this implies a total value of 94 cents per share. That's still 9% below where the ASX All Ords share is trading at the time of writing. And, as ARN notes, that's "before taking into account the benefit of any franking credits distributed in connection with the proposed transaction".

Should it go through, ARN said the transaction and separation will result in two distinct national media organisations which would compete independently on metro and regional radio.

Commenting on the offer that's sending the Southern Cross Media share price soaring today, ARN CEO Ciaran Davis said:

There is a significant value creation opportunity bringing together certain ARN and SCA radio and digital audio assets. ARN is ideally positioned to support and operate an expanded regional radio network and as a combined group of scale in digital audio, positioned to compete efficiently and effectively with international competitors.

Southern Cross told shareholders that the takeover proposal is "unsolicited, complex, and highly conditional".

Management of the ASX All Ords share recommended shareholders do not take any action at this time.

They said the offer remains subject to the unanimous recommendation of the Southern Cross board, due diligence, along with shareholder and regulatory approvals from the ACCC and ACMA.

Southern Cross Media has appointed Grant Samuel as its financial adviser and Corrs Chambers Westgarth as its legal adviser to further study the proposed takeover.

Stay tuned.

How has this ASX All Ords share been tracking longer-term?

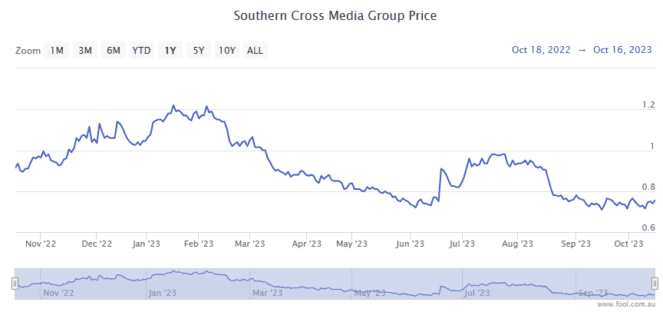

With today's big boost factored in, the Southern Cross Media share price is down 7% over the past 12 months.

The ASX All Ords share is down 20% in 2023.