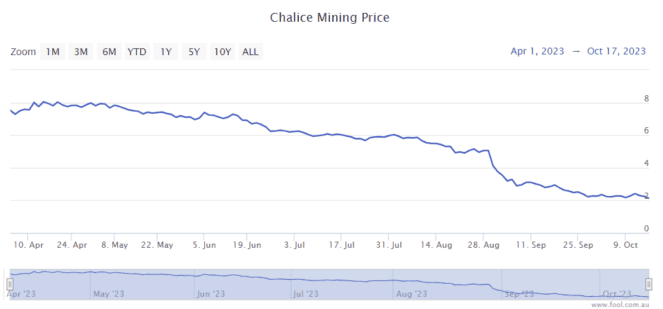

The Chalice Mining Ltd (ASX: CHN) share price has fallen heavily, the ASX mining share is down by around 75% in the last six months, as we can see on the chart below.

Following this heavy decline, we're going to look at whether this is an opportunity to buy the ASX share.

For readers who haven't heard of this miner before, there are two projects that the business is focused on.

The key project is its 100%-owned Gonneville nickel-copper-platinum group element (PGE) project in Western Australia. It's also exploring the potential of the West Yilgam nickel-copper-PGE province to deliver more discoveries, which includes Julimar.

Does the miner have an attractive long-term future?

The company points out that the current supply of green metals is forecast to fall "well short" of what is required to decarbonise the global economy. It believes the continued urbanisation of the world's population also adds "further demand for these metals that are critical to modern life."

There are various reports, such as one released by the International Energy Agency, that forecast strong demand for things like copper and nickel because of electric vehicles, wind turbines and so on.

The ASX mining share also notes that the number of new discoveries and the new mines being built in the Western world is "rapidly declining".

It also says:

The strategic value of a new large-scale project like Gonneville, in one of the world's most stable and supportive mining jurisdictions, is obvious when considering this macroeconomic environment. Gonneville is not only the first major platinum group element discovery in Australia, it is also one of the few recent large-scale magmatic nickel-copper-PGE discoveries in the western world – a rare, tier-1 scale mineral resource that has the potential to create significant long-term value for Chalice shareholders and stakeholders.

Is this a good Chalice Mining share price to invest at?

We can certainly make good returns when it comes to cyclical sectors such as mining. It just means investing at the right time and capitalising on the right price.

The ASX mining share acknowledged that there has been some share price weakness and it "may take some time for equity markets to understand the project's full potential, given the early stage nature of studies to date."

This company had $145 million of cash at the end of FY23, so its balance sheet is in good shape for the foreseeable future as the miner works on delivering its projects.

The fact that it's 75% lower than it was earlier this year shows to me that it's much cheaper.

According to analyst opinions collated by Factset, Chalice Mining shares have two buy ratings, four hold ratings and one sell rating.

I'm not an expert on ASX mining shares, particularly ones in the development stage. However, this seems like a massive sell-off for a business making good progress towards production, with its commodities projected to see growing long-term demand.

I think it could be an opportunity, though high-risk, at this price. I'm not expecting a turnaround next week, but I wouldn't be surprised to see investor sentiment change again within a year or two considering how volatile miners can be.