The NIB Holdings Limited (ASX: NHF) share price looks like an attractive long-term investment opportunity to me.

I don't mind short-term volatility with a company like this one because the ASX healthcare share is an effective way to play a strong investment trend, in my view.

It can be tricky to find investment ideas that can truly play the healthcare theme because some companies only 'tap' one area of the sector. Certain treatments or technology may be challenged by a competitor. For example, just look at the pain being suffered by CSL Limited (ASX: CSL) and Resmed (ASX: RMD) amid the rise of 'weight loss' drugs like Ozempic.

Here are the three main reasons I think now is a good time to invest at the current NIB share price.

Broad exposure to the health industry

I believe NIB is an effective way to access healthcare (spending) exposure because it's used for a wide variety of healthcare reasons, and it can generate earnings from people when they're not spending as well. Additionally, people earning above a certain income are 'encouraged' to get private health insurance just to avoid the Australian Tax Office's Medicare levy surcharge.

In my opinion, NIB is an effective 'picks and shovels' choice. What does that mean? In the olden days, people would try to find a commodity such as gold. If they found gold, they could be rich, but equally, they might not find anything at all.

However, the people selling picks and shovels to those miners would gain business and make money, whatever the outcome. It wasn't a high-risk industry, but it was a play on the gold rush.

Health spending is expected to keep rising (including as a percentage of GDP) for many years to come, and I believe healthcare insurance is an effective way to ride that trend. It doesn't require the business to 'strike gold' on a treatment or continue having the best health-related device.

It seems like a smart move by the business to expand in areas that are similar to what NIB currently offers and where spending could rise, such as NDIS businesses and travel insurance.

Population growth helps

I like investments that benefit from population growth. Whether we agree or not with the large annual increases in Australia's population, there are some industries that are clear beneficiaries.

The bigger the Australian population, the more likely it is that the NIB's Australian Resident Health Insurance (ARHI) membership can keep growing and boost earnings.

In FY23, the NIB ARHI membership increased by 4.7%, which is the strongest result since FY15 and more than double the anticipated industry growth. This will likely support the NIB share price.

In addition, the company is benefiting from an influx of international workers following the end of COVID-19 border closures. In FY23, international inbound health insurance saw policyholder and premium growth of 15.7% and 22.4%, respectively.

Increasing scale can help the business deliver stronger earnings over time, in my opinion. In FY23, the NIB underlying operating profit increased by 11.1% to $263.2 million.

Valuation and dividend

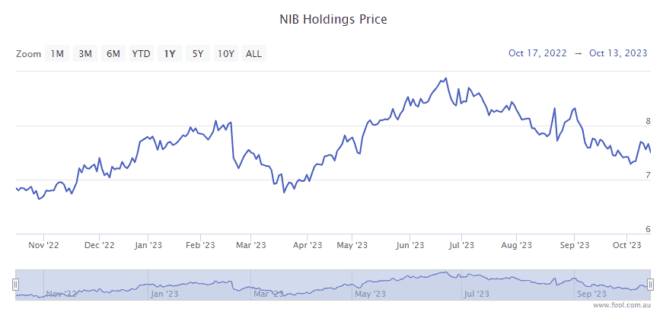

Since 21 June 2023, the NIB share price has declined by almost 20%, making it quite a bit cheaper than it used to be.

According to the earnings forecast on Commsec, the company is valued at 17x FY24's estimated earnings and less than 16x FY25's estimated earnings. I don't think this is a demanding price/earnings (P/E) ratio for a long-term growth business.

The dividend is projected to keep growing. In FY24, the grossed-up dividend yield could be 5.6%, and in FY25, the grossed-up dividend yield could be 6%. The rising dividend can help shareholder returns, which is another positive factor.