It's sound logic to think consumer discretionary businesses will struggle this festive season, with many Australians straining under the weight of 12 interest rate rises.

However, one expert thinks that certain ASX shares in that area could still pull off the traditional Christmas Rally.

It's all about analysing where Australians would go to save money during tough times, according to Moomoo market strategist Jessica Amir.

"With Australian consumers running low on savings amidst cost-of-living pressures, families are likely heading on camping trips, opting for domestic travel as well as upgrading cars and home entertainment this holiday season."

Amir and her team likes the look of four stocks in particular for a late-year climb up the charts:

Fun at home or out camping?

While GUD Holdings Limited (ASX: GUD) does make automotive parts, Amir is attracted to its water maintenance products.

"With more families intending to stay home for the summer and invest in backyard spas and pools, or beautify their yards by pressure washing their driveways, or buying a new lawnmower, we can expect consumer and industrial pump and appliance businesses GUD Holdings to continue to grow its sales and earnings."

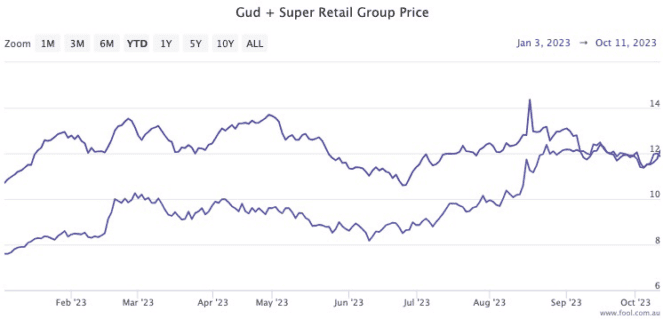

Her team reckons GUD Holdings is a definite Santa Rally candidate despite already having soared in 2023.

"Its shares are up 56% YTD."

For those Australians that do still want to get away, Amir thinks they will be avoiding expensive hotels.

That's why she is pointing out Super Retail Group Ltd (ASX: SUL) as a Christmas Rally candidate.

"As the parent company of major outdoor retailers including BCF, Supercheap Auto, Macpac etc, this stock is primed to lift with the increase of happy campers and more frugal outdoor activities these holidays.

"We're already seeing their shares grow by 9% YTD."

Christmas Rally on the back of Aussie road trips

And just how will those Aussies head out to those camping sites?

This is where Eagers Automotive Ltd (ASX: APE) could come in.

"As Aussies face a stingy Christmas with power and gas bills and rents rising, international travel might be off the cards.

"So Aussies may more be inclined to upgrade their cars and head on road trips."

The current car market is hot for dealers like Eagers as supply constraints still rule and US car factories are suffering from strikes.

"So Australia's largest car dealership is likely to reap a lift in profits," said Amir.

"Looking ahead, we know supply will be limited as well, while car makers will likely increase their prices. Eagers shares have already started to benefit and are up 31% YTD."

And once you've driven to your destination, you need somewhere to stay.

Enter Ingenia Communities Group (ASX: INA), which owns and operates holiday parks around Australia, as the final Christmas Rally candidate.

"Amid cost-of-living pressures, you can expect to see more families… headed to tourism parks around Australia, giving companies like Ingenia Communities a summer holiday boost in sales and revenue."

She did note that Ingenia shares are down more than 9% so far this year.

"Ingenia Communities Group shares are down 9.3% YTD, but it's likely to head to higher ground in the coming months, as its history has in the final quarter of the year."