The CSL Ltd (ASX: CSL) share price is experiencing a slump on Thursday amid another possible application for weight-loss drugs.

At the time of writing, shares in the biotechnology behemoth are skating 3.9% lower to $244.33. The drop is a stark departure from the 0.23% gain across the broader S&P/ASX 200 Index (ASX: XJO), which would be higher if not for the dead weight of the Aussie market's healthcare sector today.

Slogged with another potential headwind, CSL shares are now within a whisker of their 52-week low once again.

Fears of an $18 billion mistake

While Australian investors were fast asleep, new details emerged of the seemingly miracle drug weight-loss drug known as Ozempic.

The drug's creator, Novo Nordisk, provided a media release shedding new light on injectable semaglutide last night. What was initially intended to treat diabetes, then morphed into a weight-loss treatment, might soon add chronic kidney disease to its umbrella of uses.

According to the release, Novo Nordisk will stop its once-a-week injection of semaglutide in its kidney outcomes trial. The trial compared injectable semaglutide to a placebo in assessing its effectiveness in preventing the progression of renal impairment in people with type 2 diabetes and chronic kidney disease.

The decision to stop the trial stemmed from a recommendation made by an independent committee as "the results from an interim analysis met certain pre-specified criteria for stopping the trial early for efficacy".

Denmark-based Novo Nordisk enjoyed a 4.9% rally in its stock price amid the announcement. Meanwhile, US-based kidney dialysis provider Davita Inc (NYSE: DVA) cascaded 16.9% as investors mulled the implications of a future with reduced kidney issues.

The pain is undoubtedly extending to CSL shares today due to the company's involvement in the kidney industry after acquiring Vifor in 2022 for approximately A$18 billion.

Vifor, which is now integrated into CSL, houses an array of medications spanning iron deficiency, dialysis, nephrology (the study of kidneys), and rare diseases. In other words, this acquisition is heavily skewed towards the treatment of kidney disease and related illnesses.

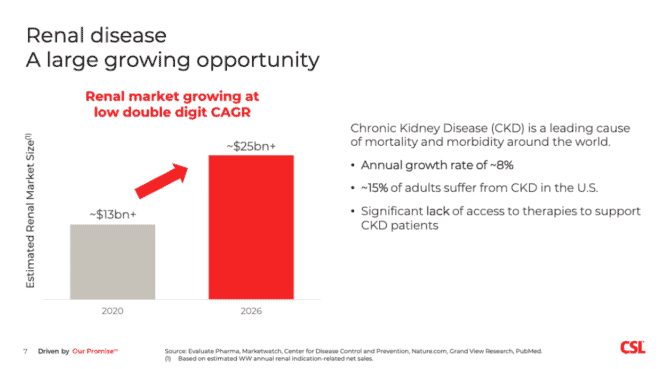

In its Vifor investor materials, CSL touted the large renal market and its high rate of estimated growth, as shown above.

Today, the market might be rethinking what future growth might look like if Ozempic can deliver better outcomes for people with kidney disease.

The share price whack also follows yesterday's annual general meeting, where investors voiced their displeasure with the company's recent performance.

Could CSL shares be cheap?

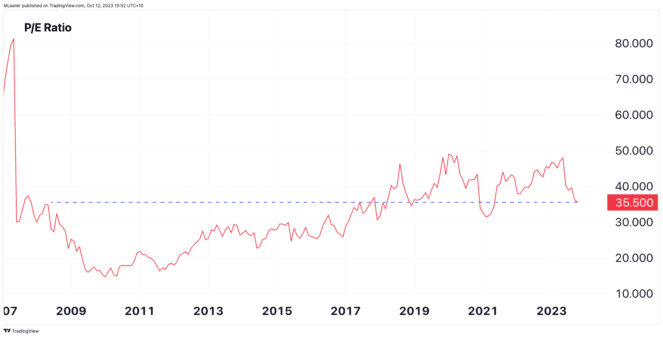

Using the price-to-earnings (P/E) ratio is a crude method for establishing a baseline on relative value compared to its historical multiple.

Nonetheless, we can see that despite the recent fall in CSL shares, the earnings multiple is not dissimilar to the past six years. Aside from a blip in 2021, investors have to go back to before 2017 to see an earnings multiple drastically below current levels, as shown below.

However, several analysts prior to the Ozempic news had CSL shares in the buy bucket. This includes Morgans, Macquarie, and Morgan Stanley, all setting a price target above $320.