The S&P/ASX 200 Index (ASX: XJO) clocked in its fifth consecutive green day on Wednesday. Not a single sector came under threat as Aussie investors followed the path set by Wall Street last night, including the country's prized ASX mining shares.

A helping of optimism was poured over the Australian share market today as expectations of further rate hikes eased — the changing tide hoisting all ships higher. Although not the best-performing sector, materials strengthened 0.99% as the iron ore giants rallied.

However, rate expectations may not have been the only factor helping ASX mining shares today. In addition, a fiscal policy being contemplated in a country 7,470 kilometres away might have also heaved BHP Group Ltd (ASX: BHP), Rio Tinto Ltd (ASX: RIO), and Fortescue Metals Group Ltd (ASX: FMG) higher.

Feeding the economic furnace

China has long been an epicentre of economic growth, propelled forward by its industrial capability. The expansion of the country's economy has also been influential in the success of many companies outside the People's Republic.

Creating unease, the once powerful economic engine has slowed to a gentle idle. Weak domestic demand has created a deflationary environment, often associated with declining business and rising unemployment.

Yesterday, the International Monetary Fund (IMF) provided a warning on China's economic prospects. IMF now forecasts China's GDP to only grow by 4.2% in 2024, a 0.3% reduction from its prior projection.

Concerningly, according to the IMF, a further 1.6% reduction could be applied if the country's real estate woes worsen. Simultaneously, pain in the property sector would likely be felt by ASX mining shares.

Faced with a slowing economy, it is believed policymakers in China are looking at their options. According to Bloomberg, at least 1 trillion yuan, or AUD$215 billion, of sovereign debt is on the table for funding infrastructure within the country.

No plans are set in stone at this stage. However, such a budget deficit would be a departure from the 3% cap put in place back in March.

Notably, my colleague Bronwyn Allen reported on the possibility of stimulus back in August. In that article, commentary shared by eToro market analyst Josh Gilbert was highlighted, whereby Gilbert suggested a weakening economy could prompt policymakers to take action.

Why ASX mining share investors pay attention to China

The moves made by iron ore companies on Wednesday were nothing to sneeze at.

- BHP Group rallied 1.3%

- Rio Tinto gained 1.4%

- Fortescue Metals Group lifted 1.6%

Due to the substantial reliance, decisions in China can sway day-to-day movements in ASX mining shares.

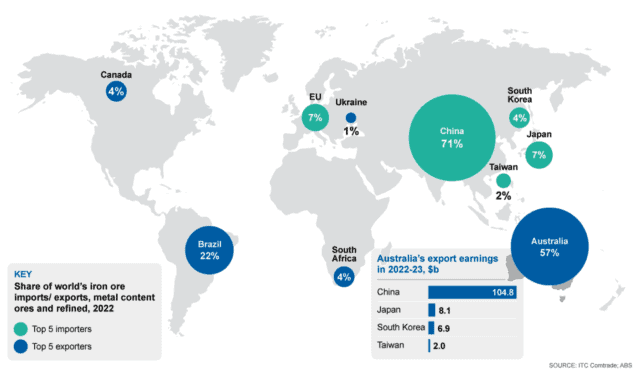

To put it into context, 71% of all iron ore imports globally flow into China, as of September 2023. Additionally, 86% of Australia's earnings from iron ore exports are attributable to the world's second-most populated country.

It stands to reason that ASX mining shares, such as BHP and Fortescue, are somewhat dependent on China.