If you're looking to buy a new car, you would be foolish not to shop around and negotiate for the best price.

You're paying tens of thousands of dollars at least, so you obviously want the best deal possible.

But for some inexplicable reason, investors don't take the same care with ASX growth shares, even though they could also be worth tens of thousands.

So if you have your eyes on a particular stock, take advantage when the prices are low. That's your equivalent of buying at the Boxing Day or Black Friday sales.

Here are two examples that are discounted right at the moment:

Growing at all costs vs managing expenses

Accounting software provider Xero Limited (ASX: XRO) has seen its share price drop more than 7.5% since the end of August.

I already own Xero shares, but am tempted to add when a dip like this comes along.

After getting punished during the 2022 ASX growth shares sell-off, the business changed chief executives and its approach.

Rather than growing at all costs, it is now more focused on positive cash flow, earnings and profit.

On the other hand, in the years to come Xero still has plenty of territory to conquer in its expansion markets like North America and the United Kingdom.

"Xero's long-term aspiration is to continue to improve its operating expense ratio and its operating income margin, although a specific timeline has not been set," management stated back in its annual results.

"These ratios, and their component parts, may vary from period to period as we identify opportunities for disciplined, customer-focused growth."

It seems professional investors are backing that the company can manage this delicate balance.

A pleasing seven out of nine analysts currently surveyed on CMC Markets rate these ASX growth shares as a strong buy.

The Xero stock price has gained an amazing 167% over the past five years.

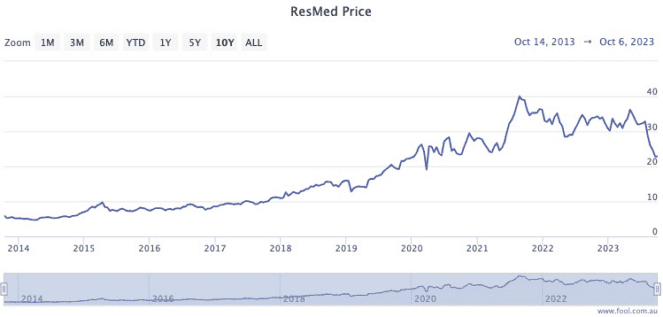

A buying opportunity after 30% dip

Meanwhile, some anxiety has hit investors in Resmed CDI (ASX: RMD).

The healthcare devices stock has dipped a worrying 30.6% since early August.

The plunge has been triggered by a worry that new weight loss drugs such as Ozempic could reduce the obesity rate, thereby reducing the addressable market for sleep apnoea.

Many experts think this scenario is overstated.

According to CMC Markets, 18 out of 24 analysts believe ResMed shares are a buy at the moment.

It seems I agree, as I topped up my holding last month.

While these new-fangled weight loss drugs have grabbed headlines in the media, the team at Morgans is not concerned about their impact on ResMed.

"We see these products having little impact on the large, underserved sleep disorder breathing market, and do not view them as category killers," read its memo to clients.

"Although quarters are likely to remain volatile, nothing changes our view that the company remains well placed and uniquely positioned as it builds a patient-centric, connected-care digital platform that addresses the main pinch points across the healthcare value chain."

Even with this recent plunge, the ResMed share price has climbed 300% over the past decade.