Commonwealth Bank of Australia (ASX: CBA) shares are holding firm on Monday despite receiving backlash from the Finance Sector Union (FSU) over further redundancies.

Shares in Australia's most valuable bank, commanding a market capitalisation of $168.3 billion, are flat at $100.02 apiece. Meanwhile, the broader financial sector is a mere 0.1% higher.

The steady CBA share price flouts criticism for cutting jobs following a $10.2 billion profit in FY23.

Automation takes a toll

In a media release this morning, the FSU revealed Commonwealth Bank's plans to cut 192 jobs across back offices in Sydney, Melbourne, and Perth. The redundancies will take CBA's employee reduction to more than 1,000 job cuts in the past six to 12 months.

The eliminated positions span multiple divisions across CBA and BankWest. According to FSU, the cuts include 47 positions in consumer finance, 21 in everyday banking, 87 in home buying operations, and 9 in BankWest lending.

Furthermore, "simplified processes" as part of "automation initiatives" have been attributed to why the roles are no longer required.

With respect to the latest lot of CBA cuts, FSU national secretary Julia Angrisano labelled it concerning, stating:

CBA has a huge problem with staff shortages and excessive workloads and cutting staff does nothing to reduce that concern for workers.

The jobs being lost are specialists across a range of areas and it is hard to believe that the bank can afford to lose so many experienced staff at the same time that it has a significant overwork problem across the organisation.

CBA is not alone in its cost-cutting crusade. All of the big four banks have taken steps to reduce their workforce in 2023. Much like Commonwealth Bank, Westpac Banking Corp (ASX: WBC) has erased 1080 positions as net margins feel the pinch of inflation.

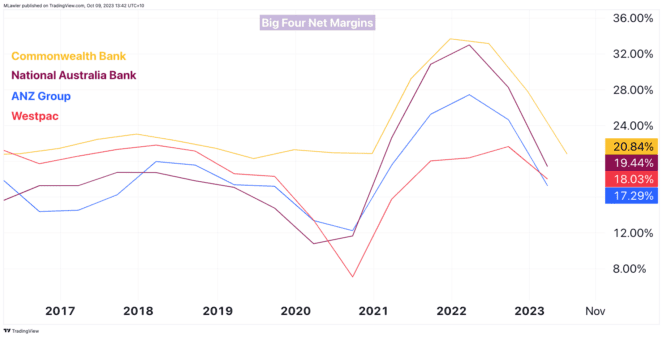

Although banks traditionally see improved margins as interest rates rise, net profit margins have declined during the last 12 to 18 months, as pictured above.

Andrew Lyons of Goldman Sachs believes rising expenses will remain an issue in FY2024. However, the analyst thinks this will be comprised of increasing software costs alongside staff payments.

Are good times ahead for CBA shares?

Macquarie analysts expect bank earnings to rise by 2% in FY24. Despite this, the team expect the banking industry to be hit by provisions for impairment charges heading toward 2025.

Rather than CBA, Macquarie has singled out National Australia Bank Ltd (ASX: NAB) as its top pick within the sector.

On the other hand, the team at Morgans are still backing CBA shares as the best risk-adjusted investment for returns over the next 12 months. Moreover, the broker is attracted by Commbank's market share, leading technology, and strong customer loyalty.

Notably, CBA shares fetch the lowest dividend yield among the big four. At present, the banking heavyweight is carrying a 4.5% dividend yield. In contrast, its competitors are offering yields of 5% or more.