Investing in a well-diversified portfolio of quality ASX shares over the long term is a surefire way to secure your financial future and build wealth.

Adding a range of shares that reward their investors with annual dividends adds extra juice to this recipe for success.

To help you decide what's hot and what's not in October, we asked our Motley Fool contributors for their thoughts on the top ASX passive income shares to invest in right now. Here is what the team came up with:

6 best ASX dividend shares for October 2023 (smallest to largest)

- Lindsay Australia Ltd (ASX: LAU), $344.44 million

- Metcash Limited (ASX: MTS) $3.69 billion

- Washington H. Soul Pattinson and Co. Ltd (ASX: SOL), $11.76 billion

- QBE Insurance Group Ltd (ASX: QBE), $23.44 billion

- Telstra Group Ltd (ASX: TLS), $44.48 billion

- Woodside Energy Group Ltd (ASX: WDS), $69.32 billion

(Market capitalisations as of 29 September 2023).

Why our Foolish writers love these ASX passive income stocks

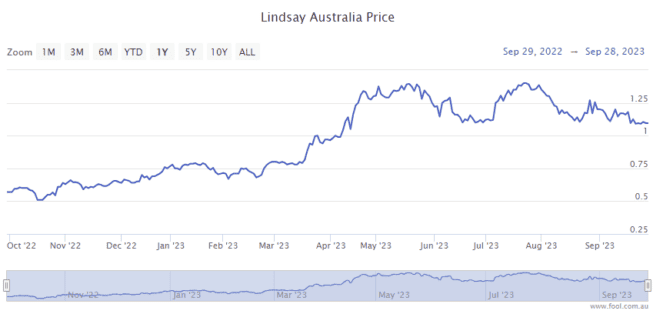

Lindsay Australia Ltd

What it does: Lindsay Australia is a transport and logistics company with three distinct operating segments: road, rail, and rural. The company provides end-to-end supply chain solutions to more than 3,300 customers Australia-wide.

By Mitchell Lawler: Trucks are often said to be the backbone of the Australian economy. Our vast country requires extensive freight hauling for our society to keep functioning.

Lindsay Australia has been providing this critical service since 1993. Over the course of time, Lindsay has built a fleet comprising 350 trucks, 700 reefer trailers, and more than 650 containers. Meanwhile, revenue has grown significantly from $283.5 million in FY13 to $680 million in FY23.

With Australia's population poised for growth and our general demand for products unlikely to decline, the tailwinds for Lindsay Australia look strong.

Lindsay Australia currently offers a free cash flow yield of around 14%. This is the amount of cash the company generates after expenses divided by the market capitalisation. In my view, this is an appealing proposition.

Motley Fool contributor Mitchell Lawler does not own shares of Lindsay Australia Ltd.

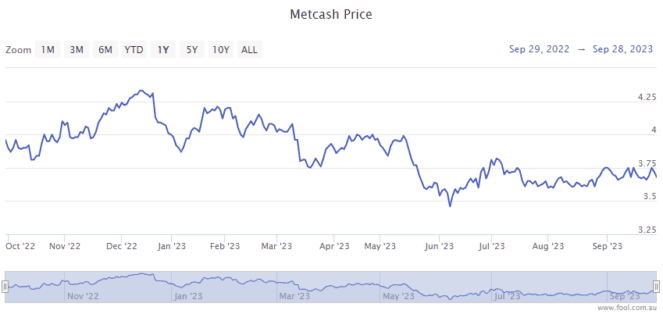

Metcash Limited

What it does: Metcash supplies all IGA supermarkets nationally, as well as independent liquor stores, including IGA Liquor, Bottle-O, Cellarbrations, Thirsty Camel and Porters Liquor. It also owns the hardware brands Mitre 10, Home Timber & Hardware and Total Tools.

By Tristan Harrison: Metcash is an ASX passive income share that I believe can show earnings resilience whatever happens next in the current economic environment.

We've already seen that resilience in the first 18 weeks of FY24 to 3 September 2023 after the company advised that total sales increased 1.7%, with all pillars delivering growth. The most profitable division, hardware, saw total sales increase 3.2%. Plenty of other retailers have reported sales declines in recent trading updates.

I believe this business is a good candidate to benefit from Australian population growth, leading to more customers.

The valuation and dividend yield look compelling to me. Commsec forecasts suggest the Metcash share price is valued at just 12x FY24s estimated earnings with a projected grossed-up dividend yield of 8%.

Motley Fool contributor Tristan Harrison does not own shares of Metcash Limited.

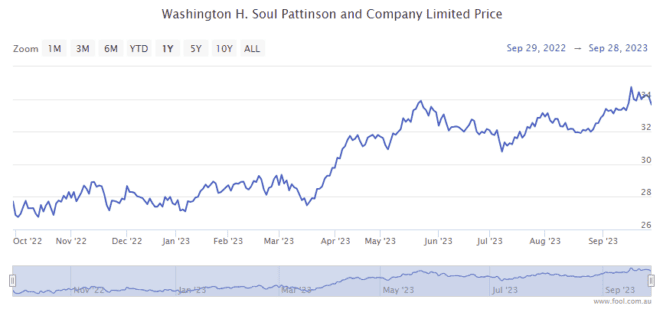

Washington H. Soul Pattinson and Co. Ltd

What it does: Washington H. Soul Pattinson, or Soul Patts for short, is an investing house that has more than 100 years of ASX history. Today, it runs a large portfolio of ASX shares and other investments and assets on behalf of its shareholders.

By Sebastian Bowen: Soul Patts is my favourite ASX dividend share, hands down. This company has a long track record of successfully delivering index-crushing returns for its investors.

At the end of last month, Soul Patts released its latest annual report. This confirmed that the company has managed to deliver an average shareholder return (including share price growth and dividends) of 12.5% per annum over the past 20 years, rising to 15.2% per annum over the past 40. That's a return that most ASX 200 shares simply can't match.

Further, Soul Patts has just announced its 23rd consecutive year of annual dividend increases. Yep, this company has lifted its annual dividend every year since 2000 at an average rate of 9.6% per annum. No other share on the ASX has such a long, unbroken history of raising its annual dividend. As such, I think Soul Patts is a fantastic passive income stock to check out this October.

Motley Fool contributor Sebastian Bowen owns shares of Washington H. Soul Pattinson and Co.

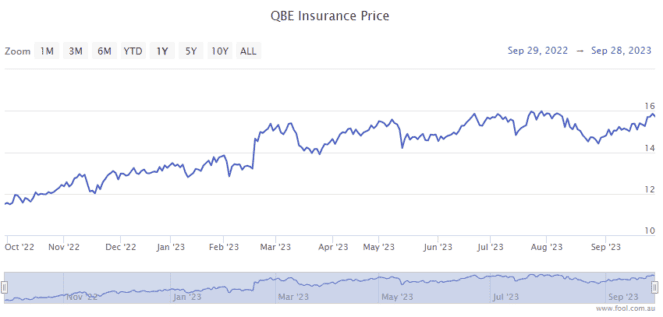

QBE Insurance Group Ltd

What it does: QBE is an insurance company providing a broad range of products for personal, business, corporate, and institutional markets. It is also involved in insurance underwriting and reinsurance, and has a local presence in 27 countries.

By Bronwyn Allen: Insurance companies are among the very few winners in today's inflationary economy because customers are willing to pay raised premiums for what they deem to be an essential product.

Goldman Sachs is backing QBE for share price growth and dividend growth. It's got a buy rating and a 12-month share price target of $18.09 on QBE. It is forecasting dividends of 60 US cents per share in FY24 and 62 US cents in FY25.

Based on a QBE share price of $15.80, this equates to yields of 5.95% and 6.15%, respectively.

Motley Fool contributor Bronwyn Allen does not own shares of QBE Insurance Group Ltd.

Telstra Group Ltd

What it does: Telstra is Australia's largest and longest-running telecommunications company, with a presence in 20 countries around the globe.

By James Mickleboro: The Telstra share price has pulled back materially since earnings season. This has been driven partly by disappointment that the company has decided to hold onto its InfraCo Fixed assets instead of selling them and returning funds to shareholders.

I think this has created a buying opportunity for income investors. Especially given the attractive forecast dividend yields and potential for market-beating share price gains.

For example, Goldman Sachs is forecasting an increase in its dividend to 18 cents per share in FY 2024 and then another increase to 20 cents per share in FY 2025. Telstra shares closed at $3.85 on Friday, meaning yields of 4.6% and 5.1%, respectively. Goldman also sees plenty of upside with its buy rating and $4.70 price target.

Motley Fool contributor James Mickleboro does not own shares of Telstra Group Ltd.

Woodside Energy Group Ltd

What it does: Woodside is Australia's largest independent dedicated oil and gas stock with operations in Australia and internationally. Woodside's energy footprint recently saw major growth following the company's successful merger with BHP's oil and gas portfolio.

By Bernd Struben: Despite the growth of EVs, global oil and gas demand continues to increase. The IEA forecasts global oil demand will increase by 2.2 million barrels per day in 2023. This comes as OPEC+ continues to restrict supplies, with the oil price now eyeing US$100 per barrel.

I believe that should continue to see Woodside deliver outsized passive income in the year ahead.

As for the year gone by, Woodside shares delivered an all-time high final dividend of $2.154. The interim dividend of $1.243 per share was paid last week for a full-year dividend payout of $3.397 per share.

That equates to a juicy, fully franked trailing yield of 9.6%.

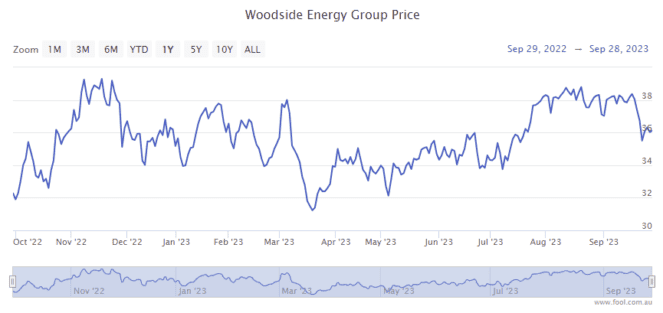

The Woodside share price has also been a strong performer over the past 12 months, up 15.2%.

Motley Fool contributor Bernd Struben does not own shares of Woodside Energy Group Ltd.