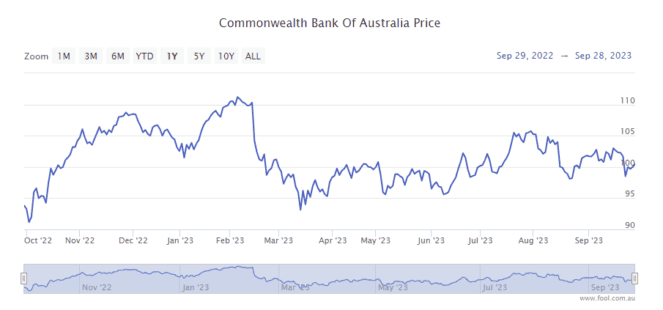

Commonwealth Bank of Australia (ASX: CBA) shares have seen plenty of ups and downs in 2023. They are currently sitting just under $100 apiece at $99.97.

The ASX bank share's outlook has changed a number of times over the past 18 months. Initially, rising interest rates were seen as a positive as it meant banks could earn stronger net interest margins (NIMs) on their loan books.

Then came concerns about competition, reducing margins and the profit growth outlook.

Competition now seems to be reducing, and it appears banks are thinking about their margins more.

What can CBA shareholders look forward to?

October is a key month for the CBA share price because the bank will hold its annual general meeting (AGM) on 11 October, 2023. This is when management reviews the latest financial year, provides a trading update for the latest quarter, and gives commentary about the outlook.

So that could be a very interesting day for the bank.

When CBA announced its FY23 result in August, it revealed that its arrears had increased at June 2023 compared to December 2022.

Will arrears have risen again to the end of September? A sizeable increase could mean that CBA has to include another profit-hitting loan impairment expense in the first quarter of FY24.

The bank also said that while its FY23 NIM of 2.07% was higher than FY22, the FY23 second half NIM of 2.05% was 5 basis points (0.05%) lower than the FY23 first half. It'll be interesting to see which way profitability has gone in the first few months of FY24, considering the changing environment in regard to competition.

Here's what CBA CEO Matt Comyn said in August:

The Australian economy has been resilient with the tailwinds of a recovery in population growth, relatively high commodity prices and low unemployment. However there are signs of downside risks building as rising interest rates have a lagged impact on mortgage customers and other cost of living pressures become a financial strain for more Australians.

We are seeing consumer demand moderate and economic growth slow and we are closely monitoring the impact of reduced discretionary spend, particularly on our small and medium sized business customers.

Comyn said the Australian banking system was strong and had "navigated rapidly changing and uncertain global financial conditions through sound liquidity risk management and strong capital regulation".

We are well provisioned for the changing financial conditions and our strong balance sheet underpins our ability to support our customers and manage headwinds while delivering sustainable returns for shareholders.

What about interest rates?

The recent jump in oil prices isn't helping the task of bringing down inflation. Fuel is one of those staples that most households and businesses have to pay for – it's an expense category that affects most of the country. More expensive supply chains may lead to companies increasing prices again.

Plus, there are plenty of price rises that are linked to inflation, such as rent and wages, so another jump in the CPI inflation figure – even if temporarily boosted by fuel – won't help. It could mean interest rates stay higher for longer, and that could be a headwind for the CBA share price.

I've been impressed by the overall strength of the Australian economy and borrowers during this period of high interest rates.

However, more households are reportedly dipping into their savings, according to the Australian Bureau of Statistics (ABS), with the household saving ratio notching up another quarterly decrease.

The past year has shown a decline in the household savings rate in consecutive quarters from 8.1% for the quarter ending June 2022 to 3.2% for the quarter ending June 2023.

Even if the RBA interest rate doesn't go up, the current rate is taking its toll on borrowers.

I'm not expecting the CBA share price to do much positive action over at least the next six months in this environment.