Rio Tinto Ltd (ASX: RIO) shares could come under scrutiny in October when the ASX miner is scheduled to release its latest operational update to investors.

The market pays a lot of attention to the half-year and annual results released by ASX companies. Miners also tell investors every three months about their operational performance. That typically involves revealing how much of their commodities they produced, as well as potentially the costs of production and even the revenue it received for the production.

Why the next update is important

There are two main factors that affect how much revenue a commodity business can generate – the price it gets for its commodity and how much it produces. Rio Tinto can't really affect the iron ore price, copper price, aluminium price, and so on. But it can impact its production.

Rio Tinto reported that in the first half of 2023, it produced 160.5mt of iron ore (up 7% year over year), 1.6mt of aluminium (up 9%), and 0.3mt of copper (down 1%).

The business is guiding that for FY23, it's expecting to produce 320mt to 335mt of iron ore from Pilbara, 3.1mt to 3.3mt of aluminium, and 590kt to 640kt of mined copper.

For iron ore, the company said said it's expecting Pilbara iron ore unit cash costs, on a free on board (FOB) basis, to be between US$21 per wet metric tonne (wmt) to US$22.5 per wmt. This compares to US$21.2 per wmt in the first half of 2023.

Outlook for Rio Tinto shares

The outlook for Rio Tinto's profit generation is still positive with the iron ore price sitting above US$110 per tonne, which means the business can generate plenty of net profit after tax (NPAT) and cash flow at this level.

Of course, there are ongoing concerns about the Chinese economy, particularly its construction sector which continues to face troubles.

However, properties aren't the only products in China that are using large amounts of steel. There are things like new (electric) vehicles being produced, wind farms, infrastructure, and so on. That could explain why the iron ore price remains more resilient than some analysts may have been expecting. As well, there has been a strong level of steel exports from China to other markets, such as India.

A couple of months ago, Rio Tinto gave an outlook statement with its FY23 half-year result. It said:

China's economic recovery has fallen short of initial market expectations, as the property market downturn continues to weigh on the economy and consumers remain cautious despite monetary policy easing. Manufacturing data in advanced economies showed a further slowdown and recessionary risks remain.

Rio Tinto share price snapshot

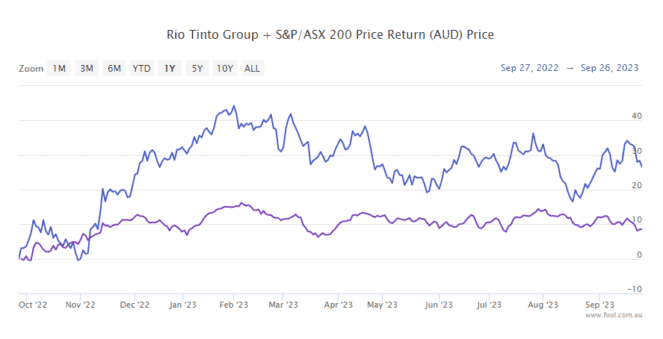

Since the start of 2023, Rio Tinto shares have fallen 4%, while the S&P/ASX 200 Index (ASX: XJO) has risen 1%.