If you're already reading The Motley Fool, then you already have some idea that ASX growth shares are capable of bringing extraordinary riches.

But there's nothing like cold hard numbers to demonstrate that power.

How would you feel about raking in a 20% compound annual growth rate (CAGR)? Does that sound too good to be true?

At that rate of growth, you can more than double your money in just four years.

Well, there is no reason why one can't achieve this with the right growth stocks.

Let's take a look at three diverse stocks from distinct industries that could have got you there in recent times:

American software making Aussies rich

Life360 Inc (ASX: 360) is a Californian software maker that chose to list on the ASX.

The company develops family security software, which has features like tracking locations of teenagers and providing emergency roadside assistance.

After listing in May 2019, the share price had a rapid rise after COVID-19 hit then sank just as quickly during the 2022 growth stock sell-off.

With interest rates surging higher, the market turned its back on cash-burning startups, of which Life360 was a prototypical example.

But the management has done an admirable job of turning the ship around. In fact, the company remarkably achieved positive cash flow in the first half of this year.

And that's why the stock has risen 82.3% so far in 2023.

But did it double in four years?

It sure did. The Life360 share price has rocketed 152% since 27 September 2019.

That's a stunning CAGR of almost 26%.

Global warming providing many opportunities

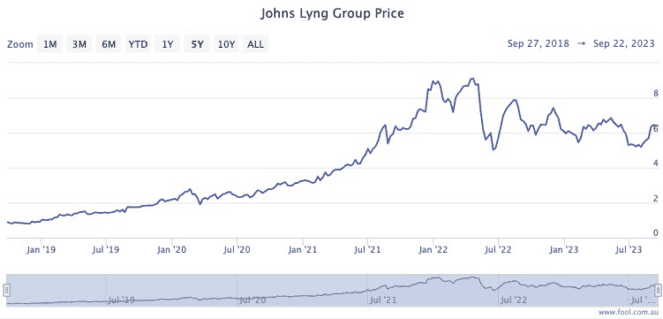

Over in construction, Johns Lyng Group Ltd (ASX: JLG) has been a favourite among investors the past few years.

The company provides claims remediation services to insurance companies, meaning that climate change and turbulent weather events have brought in an unprecedented volume of work.

Professional investors love its prospects, with eight out of 10 analysts currently surveyed on CMC Markets recommending Johns Lyng as a buy.

So how much has this one returned to investors over the past four years?

The Johns Lyng share price has soared 265% from its closing price on 27 September 2019.

That equates to an amazing annual growth rate of 38%.

Helping patients fight the big C

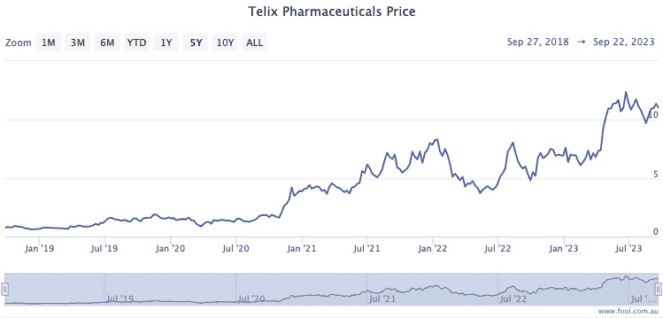

Moving onto biotechnology, Telix Pharmaceuticals Ltd (ASX: TLX) has been turning heads ever since it released its first commercial cancer product last year.

It's thrilling for investors who have put faith in such a company during the research and development phase to see it successfully sell products in the commercial world.

And the outlook is excellent for Telix, as it has more cancer diagnostic and treatment products in the pipeline, which have trials and approvals ahead of them.

Even though the share price has already doubled in the past year, CMC Markets reports all seven analysts that cover the stock are rating Telix as a buy.

Guess how much Telix shares have grown the past four years.

The stock is now trading 621% higher than it did at the close of 27 September 2019.

How is 64% CAGR for you? Is that good enough?