The natural tendency for humans is to worry about worst-case scenarios.

It's a survival instinct evolved over time. If you were that caveman or woman who didn't think they would be eaten by a lion, you died out a long time ago.

And there is no relief in sight for this defensiveness in modern life with the 24-hour news cycle, according to AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver.

"The 'news' as presented to us has always had a negative bent, but one could be forgiven for thinking that it's become even more negative with constant stories of disasters, conflict, wrongdoing, grievance and loss," Oliver said on the AMP blog.

The trouble is, for those of us who buy ASX shares, this negativity could block us from investment success.

"It seems that the worry list for investors is more threatening and confusing. This was an issue prior to coronavirus – with trade wars, social polarisation, tensions with China, worries about job loss from automation and ever-present predictions of a new financial crisis," said Oliver.

"Since the pandemic higher public debt, inflation, geopolitical tensions and rising alarm about climate change have added to the worries."

Why are we all so down these days?

Of course, risks should not be ignored.

But the information barrage can make investors excessively pessimistic about the future than necessary, said Oliver.

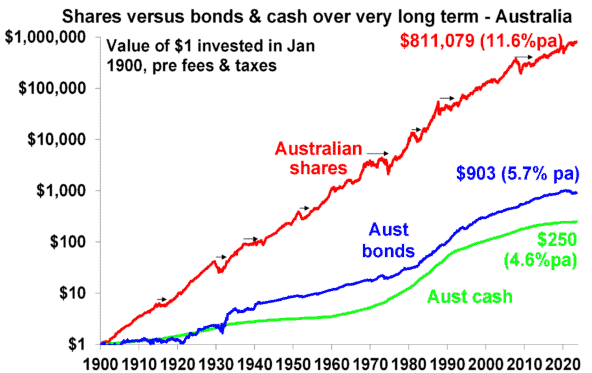

"When it comes to investing, the historical track record shows that succumbing too much to pessimism doesn't pay."

The economist attributed this phenomenon to three reasons: biological instinct, information overload, and media competing for attention.

"We can now check facts, analyse things, [and] sound informed easier than ever. But for the most part we have no way of weighing such information and no time to do so.

"This comes with a cost for investors… When faced with more — and often bad — news we can freeze up and make the wrong decisions with our investments."

The defensive biological instinct, when translated into investing behaviour, is called "loss aversion".

"A loss in financial wealth is felt much more negatively than the positive impact of the same sized gain," said Oliver.

"To get our attention news needs to be entertaining and, following from our aversion to loss, in competing for our attention dramatic bad news trumps incremental good news and balanced commentary."

Put a smile on your dial

So if you are aiming for investment success in the long term, you need to become an optimist.

After all, as Oliver pointed out, why are you even investing if you don't even have a shred of hope?

"If you don't believe the bank will look after your deposits, that most borrowers will pay back their debts, that most companies will see rising profits over time supporting a return to investors, that properties will earn rents, etc., then there is no point investing.

"To be a successful investor you need to have a reasonably favourable view about the future."

Of course, this doesn't mean unconditional optimism. One still needs to be careful not to fall for fads and trends.

"If an investment looks too good to be true and the crowd is piling in, then it probably is — particularly if the main reason you are buying in is because of huge recent gains," said Oliver.

"So, the key is cautious, not blind, optimism."

Pessimism also leads to attempts to time the market by selling out.

But trying to time the market likely means missing out on the biggest gains as the market climbs out of the trough.

"Getting too hung up in pessimism on the next crisis that will, on the basis of history, drive the market down in two or three years out of ten may mean that you end up missing out on the seven or eight years out of ten when the share market rises."