A commonly regurgitated principle in investing is that higher risk equates to higher returns. You might be shocked to know the evidence is to the contrary. This begs the question: Why not invest in reasonably predictable (daresay, even dull) ASX All Ord shares if higher risk can go unrewarded?

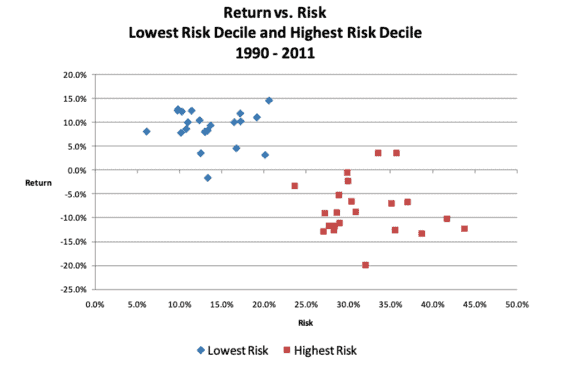

A paper published by Robert Haugen and Nardin Baker in 2012 concluded that companies with low share price volatility tended to outperform the more volatile (or riskier) companies over 21 years, depicted below.

According to billionaire investor Terry Smith, it all comes back to human psychology. We tend to sway from seeking certainty to embracing the long shot, rationalising away the sweet spot found somewhere in between.

As a result, companies with a high level of predictability but not certainty are frequently undervalued. This is despite many such businesses demonstrating consistently strong fundamentals, including exceptional growth rates.

Unexpectedly fast-growing ASX All Ords shares

I decided to scout out a few ASX-listed companies that might fit into what I will call the "boring and still performing" category.

These ASX All Ords shares operate in well-established, not-so-flashy industries yet have grown their revenue at a compound annual growth rate (CAGR) of 20% or more over the past five years.

Johns Lyng Group Ltd (ASX: JLG)

Johns Lyng Group provides building and restoration services in Australia and the United States. In a nutshell, when disaster strikes, Johns Lyng is often the team governments and insurance companies call in to rebuild.

This straightforward business has grown its revenue at a CAGR of 33% over the past five years. Specifically, revenue has grown from $277.6 million in the 2017 calendar year to $1,159 million in CY2022.

JLG chart by TradingView

The rapid top-line growth has undoubtedly been supported by a series of devastating natural disasters in recent years. At the same time, management has made multiple acquisitions during this period as earnings grew.

Aussie Broadband Ltd (ASX: ABB)

Providing telecommunications in Australia is an age-old business. Fun fact: Australia's first telephone connection was made in 1879 — 144 years ago. It's a service we've all come to rely on, but not one that's particularly exciting.

Like other telcos, Aussie Broadband sells NBN internet plans to its customers. Although, unlike many of its peers, Aussie Broadband is rapidly growing its revenue and taking market share.

ABB chart by TradingView

It's important to note the company's revenue growth occurred over the last three years due to Aussie Broadband only listing in 2020. Nevertheless, this ASX All Ords share touts a five-year revenue CAGR of 74%.

PSC Insurance Group Ltd (ASX: PSI)

The last "boring and still performing" company on my list is PSC Insurance Group.

Insurance broking is a relatively mundane industry. That's not to say it isn't important. For many, it is an absolute necessity in order to protect against complete financial loss. However, these aren't the type of companies that often command the oohs and ahhs of onlookers.

That's exactly how an ASX All Ords share such as this one can go unnoticed. The incredible five-year revenue CAGR of 25% is overlooked while investors go hunting for a more stimulating stock.

PSI chart by TradingView

As shown above, the company's revenue has grown from $111.6 million in CY2018 to nearly $300 million in the 12 months ending 30 June 2023.