The high-flying DroneShield Ltd (ASX: DRO) share price has been tempered today following its latest quarterly results.

In afternoon trade, shares in the counter-drone technology company are down 3% to 32.5 cents. Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is flirting with 5-months highs after headline inflation arrived below market expectations.

Today's negative move builds upon a week of poor performances, taking the DroneShield share price down nearly 15% over seven days. Strangely, the reaction is in response to a record result for the company.

Growth in all the right places

A month of promising updates and contract wins set the scene for DroneShield. The company has now handed down another record quarter for cash receipts by a significant margin, adding to recent positive announcements.

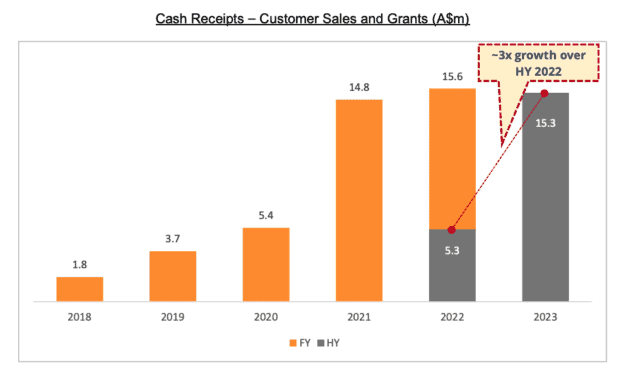

As per the quarterly report, DroneShield pulled in $8.2 million in customer sales and grants during the June-ending quarter. As a result, cash receipts for the first half of FY23 now stand at $15.3 million, representing a 200% increase on the prior corresponding period.

The record result means DroneShield has generated nearly as much in half-year cash receipts as it did in the previous full year, as shown below.

The company noted a 'favourable macro environment' as a 'rapid momentum' driver. Furthermore, the ongoing Ukraine conflict was said to be highlighting the use of drones on the battlefield. That is an eerily accurate statement, given that Ukrainian grain ports were bombed by Russian drones earlier this week.

Despite the surging cash receipts, DroneShield's operations are still cash flow negative. Around $3.2 million was consumed by its operations during the quarter, possibly adding to the pressure on the DroneShield share price today. As a result, the company's cash balance was reduced to $45.9 million.

Looking forward, the contracted order backlog is at an all-time level of $62 million. Furthermore, DroneShield now has a sales pipeline of over $200 million.

Commenting on meeting customer demand and landing more contracts, CEO Oleg Vornik stated:

On the operations/fulfilment front, we have been progressing well on the $67 million of equipment in production. Larger customers are focussed on production rates and ability to fulfil bigger contracts, so executing production in unison with sales activity is important.

Why is the DroneShield share price falling?

It's impossible to precisely put a finger on what is pushing shares lower amid today's results. However, it's worth keeping in mind the company's shares have rallied substantially in July.

Initially ignited by its $9.9 million DoD contract on 4 July, the DroneShield share price has climbed over 40% in less than a month. Meanwhile, the S&P/ASX Small Ordinaries Index (ASX: XSO) is up a measly 3.3% in comparison.

At approximately 12 times FY22 sales, the market could be engaging in some profit-taking today.