The Westpac Banking Corp (ASX: WBC) share price has dropped around 12% from the January 2023 high. In this article, I'm going to outline three factors that could suggest the ASX bank share is cheap.

Firstly, it's understandable why the stock has been falling – competition in the sector is strong and higher interest rates are putting a lot of pressure on borrowers. Arrears may rise if things don't improve soon.

But, the Westpac share price may be cheap enough to reflect the difficulties of the outlook for the following three reasons.

Low earnings multiple

One of the easiest ways to compare profit-making companies is by looking at the price/earnings (P/E) ratio, which shows what the earnings multiple the (Westpac) share price is trading at.

According to Commsec, it could generate $2.12 of earnings per share (EPS) in FY23 and $1.95 of EPS in FY24.

Those numbers put Westpac shares at 10 times FY23's estimated earnings and 11 times FY24's estimated earnings.

These estimates say that the business is at a cheap price for how much profit it could make.

Big dividend yield

The ASX bank share's P/E ratio is now so low that the dividend yield has been pushed to a high level.

The annual dividend per share is projected on Commsec to be $1.40 in FY23 and $1.42 in FY24.

If the dividend yield is big enough, then investors don't need much capital growth to generate satisfactory total shareholder returns.

The grossed-up dividend yield could be 9.5% in FY23 and 9.6% in FY24 at the current Westpac share price. While the passive income is very good, we need to make sure that it's a good price to invest at.

Looking at my final point (below) could highlight why the bank appears cheaper now than it has been in some years.

Price-to-book ratio

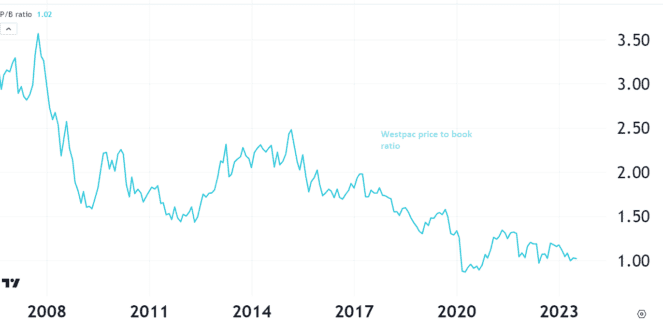

There's an investing guideline that says if a bank is trading at a price-to-book ratio of less than 1 then it's looking cheap, and over 1 isn't as good value.

The Westpac price-to-book ratio is now at around 1 which, as we can see on the chart above, is close to the cheapest it has been over the past 15 years.

Foolish takeaway

There is a number of factors that says the Westpac share price is priced cheaply though I wouldn't bet on the ASX bank share delivering large capital growth, due to the strong competition which doesn't seem to be going away.

For investors interested in Westpac shares, this could be a good time to invest, though there may be other ASX (dividend) shares that could provide stronger returns.