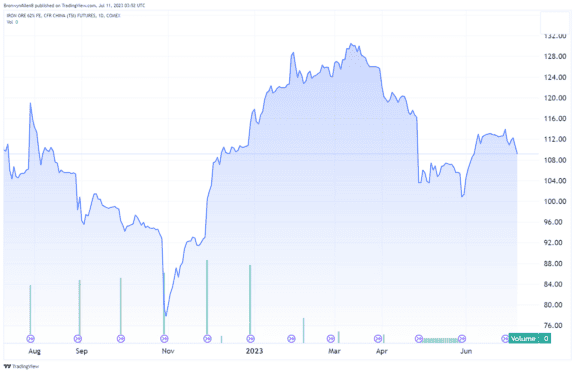

The iron ore price has dropped from above US$130 per tonne in mid-March to less than US$110 per tonne today.

As you can see in the chart below, it actually fell lower in recent times to just over US$100 per tonne at the end of May before recovering a little to where it is today.

But Commonwealth Bank of Australia (ASX: CBA) analysts see more pain ahead for the iron ore price.

Let's look at what's happening now and what the analysts think will happen next.

What's happening with the iron ore price?

Lower demand has driven the commodity's downward movement as the world watches what's happening in the Chinese economy.

China is crucial to the iron ore price because it's the world's biggest importer by a long shot. It imports 71% of the world's iron ore, according to Australian Government data.

China has not recovered as well as expected since lifting its COVID restrictions in late 2022.

According to analysis from Trading Economics:

A batch of concerning data underscored the country's struggle to recover from pandemic lockdowns, especially hitting the essential property sector.

The official manufacturing PMI showed another contraction in May, while imports sank and loan growth missed estimates.

In the meantime, the PBoC also aimed to ease developers' debt struggles with a CNY 2 billion liquidity injection and a 10bps cut in key interest rates.

There is speculation the Chinese Government may implement stimulus measures to prop up its construction sector.

Any such stimulus may be announced at the semi-annual economic conference later this month.

What do the experts think?

According to The Australian, CBA mining and energy commodity strategist, Vivek Dhar says China's weakening steel demand and increasing iron ore supplies will weigh on the commodity's value.

He estimates the iron ore price will average $US100 per tonne in Q4 2023 with "downside risk".

Dhar noted the recent comments of Rio Tinto Ltd (ASX: RIO) chair, Dominic Barton, who said "there is a big real estate issue" in China.

This is a problem because the local property sector drives China's steel manufacturing demand.

Dhar says this increases the likelihood of stimulus support, but it will probably be limited given China is targeting lower economic growth than usual in 2023.

Dhar says:

Solving the issues of the property sector will be tricky given confidence and demand are so subdued following the fallout from property developer defaults and falling new home prices through 2022.

As a result we think any support for the property sector will need to be longer and stronger than previous policies. Stabilisation will be more realistically realised next year.

As my Fool colleague James recently reported, top broker Goldman Sachs also expects a pullback in the iron ore price.

It is tipping an average of US$93 a tonne in 2024 due to lower demand and higher supply.

Goldman is forecasting the iron ore price to average US$85 a tonne in 2025 and US$84 a tonne in 2026.

What does this mean for ASX 200 mining shares?

In short, nothing good!

The commodity's value has a direct impact on the earnings of ASX 200 iron ore shares.

Usually, when the iron ore price is rising or falling, so do the share prices of stocks like BHP Group Ltd (ASX: BHP) and Rio Tinto.

As we reported recently, the Australian Government forecasts iron ore export earnings to decline from $123 billion in FY23 to $110 billion in FY24 and $93 billion in FY25 because of a lower iron ore price.

The government expects the iron ore price to fall from an average of US$98 per tonne in 2023 to US$81 per tonne in 2024 and US$71 in 2025.

These are the official forecasts from the Department of Resources. They are typically more accurate than the Budget forecasts, which tend to be deliberately conservative for planning purposes.