The final curtain is nearing on ASX nickel mining share Mincor Resources NL (ASX: MCR) as Fortescue Metals Group Limited (ASX: FMG) founder Andrew 'Twiggy' Forrest moves forward with his takeover.

Last night, Wyloo Metals — a private company owned by Forrest and his wife — announced it had accumulated a 92.71% interest in Mincor. As a result, Wyloo will move forward to compulsory acquisition of the remaining shares in the nickel mining company.

Twiggy eyes a bright future for the critical mineral, pouring $760 million of the Forrest empire into Mincor. Further fortunes will undoubtedly be tipped in over the coming years, with the mining magnate declaring his willingness to invest "whatever it takes" to put the operations on the global nickel stage.

Could EVs deliver a green nickel push?

Lithium has become synonymous with electric vehicles (EVs). You could say this is a no-brainer considering the dominant battery chemistry is lithium-ion. But, as Tesla boss Elon Musk has said before, "Lithium is actually 2% of the cell mass."

You might be surprised that the two most common batteries depend heavily on nickel. According to Greencars, there are roughly 4.5 pounds of nickel for every pound of lithium carbonate in a lithium-ion EV battery cell.

Assuming EV sales follow forecasts over the next decade, demand for nickel could follow, bolstering ASX nickel shares. Estimates from McKinsey & Company suggest global nickel demand will increase to between 3.5 to 4.0 million tonnes by 2030, up from 2.2 million tonnes in 2020.

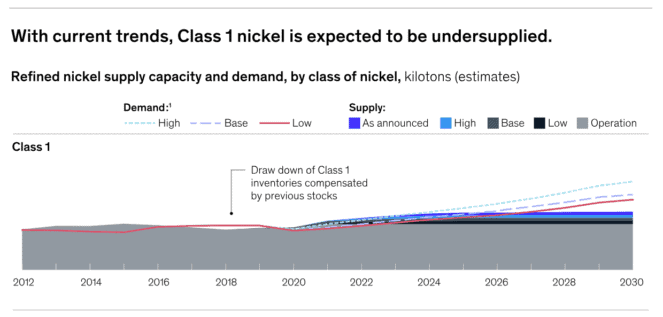

Furthermore, high-quality battery-grade nickel is forecast to be undersupplied during the second half of this decade. Based on McKinsey's modelling, the shortfall could be as early as 2024 under a high-demand scenario, as shown below.

Before the dust has settled on Mincor, Wyloo is already open to making its nickel deal. In response to the potential of consolidating the Kambalda nickel mining district, Wyloo CEO Luca Giacovazzi said:

Do we have appetite to do more deals? I'm always going to answer the same way: Yes.

No more Mincor. Which ASX nickel shares are left?

The local bourse will soon be one nickel player down for those looking to capitalise on the possibility of enjoying its 'lithium-like' moment. As Wyloo gobbles up the last of Mincor's shares, this company is as good as gone from the ASX.

Nonetheless, a long list of ASX nickel shares is still on offer. In the big end of town, for example, there are established companies, including:

Meanwhile, toward the more speculative side of the market, there are companies such as Centauras Metals Ltd (ASX: CTM), Lunnon Metals Ltd (ASX: LM8), and Poseidon Nickel Ltd (ASX: POS).

However, it is worth noting that alternative battery chemistries are constantly being explored. Last month, lithium iron phosphate was said to be closing the performance gap on the incumbent options. If an alternative to nickel blends is discovered, it could weigh on ASX nickel shares.