Sayona Mining Ltd (ASX: SYA) shares have outpaced the leading Aussie index over the past year. Now valued at $1.7 billion, can the lithium project developer continue to deliver for its shareholders moving forward?

Following a 22.9% gain over the preceding year, the next financial year will become the new focus for Sayona investors. Given that the mining company is still in the 'project development' stage, the main concern will no doubt be on Sayona reaching production as soon as possible.

Working towards money making

It's hard to argue that Sayona Mining shares are not at the more speculative end of the market at the moment. In its quarterly report for the March ending period, only $482,000 in cash from customers was generated, while net cash from operating activities arrived at an outflow of $37.6 million.

As the saying goes, "In the short run, the market is a voting machine, but in the long run it is a weighing machine." To support that lofty $1.7 billion valuation, Sayona must eventually come through with some meaningful revenue and earnings.

Fortunately, commercial-grade spodumene concentrate has now been produced at the North American Lithium (NAL) operation in Québec. In a recent interview, Sayona finance manager Dougal Elder noted that the company almost had enough tonnes produced to fill the first shipment from NAL, with the first concentrate shipment expected in July.

Last week, Sayona Mining shares barely budged despite a revised combined net present value for NAL of $5.4 billion. This might be due to current estimates placing downstream processing capability in the 2026 calendar year.

Nevertheless, Sayona is anticipating making multiple unprocessed ore shipments in FY24, which should provide some level of revenue. However, the true value proposition being promoted by management is becoming the only lithium operation with a concentrator and carbonate plant on the same site in North America.

Will Sayona get there without severe share dilution?

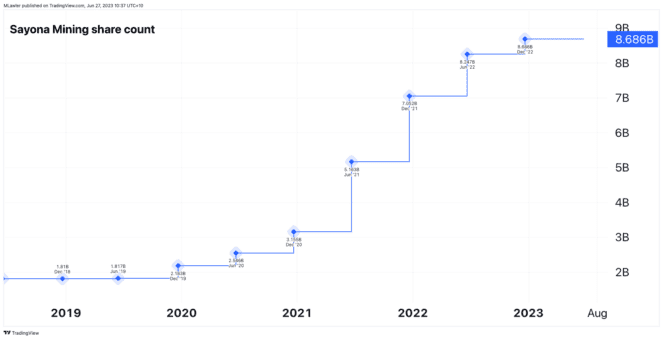

Arguably, dilution is the most significant risk to holders of Sayona Mining shares while waiting for profits. Bringing a mining project to life is costly, and the lithium projects this miner is working on are no exception.

According to the latest preliminary study, NAL will require an additional US$415 million in capital expenditure. Most of the A$200 million raised in May will go toward these efforts. However, more financial firepower may be needed.

As shown above, the number of Sayona Mining shares on issue has nearly quadrupled over the past three years. Depending on how much revenue the company can derive from ore shipments and the execution of construction, more dilution could be on the horizon.

For now, Sayona's balance sheet looks relatively strong. At the end of last year, it held A$95.5 million in net cash, with a further $256 million being raised since then.