Cash in the bank is now earning more than 5% interest, but it's still a world away from what one ASX dividend share is offering.

At a dividend yield of 26%, Yancoal Australia Ltd (ASX: YAL) looks too good to be true. The coal mining company paid out a motza to its shareholders as coal prices exploded in 2022. In the space of a year, prices for the commodity tripled.

However, with prices now plummeting back to reality, would it still be wise to seek passive income from this company?

What could future payments look like?

While the 26% figure might attract dividend investors to Yancoal like moths to a flame, it is important to remember this is a lagging indicator. What investors can expect to get paid in the future will depend on forward earnings.

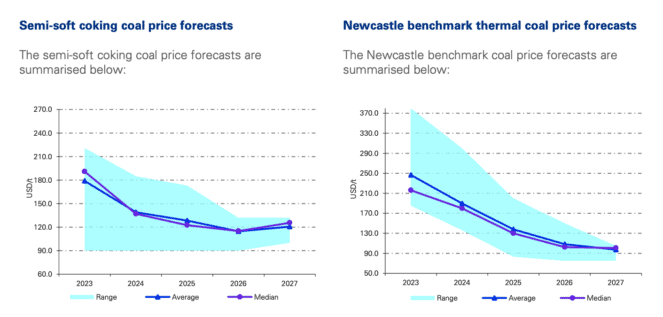

Realistically, the dividend income provided by Yancoal will be heavily dependent on the direction of coal prices in the coming years. According to KPMG forecasts, both metallurgical and thermal coal prices are expected to trend downwards, as pictured below.

Based on these estimates, metallurgical coal could reach US$120 per tonne in 2026. Meanwhile, thermal coal could decline to as low as roughly US$90 per tonne in 2027.

Looking at past operating margins and earnings, it appears Yancoal is able to generate profits as long as the average coal price remains above approximately US$80 per tonne (adjusting for inflation).

This would align with positive earnings anticipated in 2023 and 2024, according to the consensus numbers provided by Commsec.

So, what could this mean for future dividends from this ASX share?

Assuming the coal miner pays out between 40% to 50% of those profits as dividends, a considerable yield might still be on offer. Consensus estimates for the next three years suggest yields above 10% on today's share price.

Why I'm not sold on this ASX dividend share

Despite Yancoal trading on a price-to-earnings (P/E) ratio of 1.6 and a trailing yield of 26%, I'll probably steer clear of this one personally.

This might seem crazy given how ridiculously cheap it looks at face value. The problem I have with Yancoal, and all other coal mining shares, is its use might now be in structural decline.

I'm not going to assert that coal is definitely dead and gone for good. And, who knows, perhaps China keeps on consuming our coal for many decades to come. Though, unlike a great product or a service, it's hard for me to know whether dividends will sustainably grow in the future for this ASX share.

Instead, I'd rather pay a fair price for a wonderful company than a wonderful price for a fair company.