The excitement surrounding artificial intelligence (AI) shares, both on the ASX and abroad, has been palpable these past few months.

Who could be blamed for their interest when some companies in this fashionable industry showcase year-to-date returns of more than 100%? What began with the release of a makeshift AI chatbot known as ChatGPT quickly snowballed into an entire sector of countless companies feverishly stapling their names to this digital revolution.

Most investors have now heard 'AI' said so many times on quarterly calls that it feels like a constant reverberation in our minds. If it were a drinking game, we'd all have passed out many times over by this point.

Times like these are when investors pull up a chair and wonder: is this the 'next big thing' or another trend that will come and go like so many others before it?

Solving Australia's productivity problem

We are all well aware of the inflationary pressure bearing down on Australians like the unforgiving outback sun. After a shock interest rate rise in June, several economists are now tipping peak rates of 4.85%, inflicting greater pain on households.

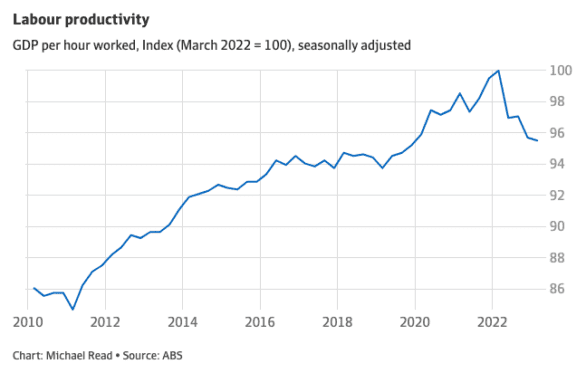

Part of the problem is believed to be Australia's waning productivity, pictured in the chart below. As Capital Economics economist Abhijit Surya puts it, "[Falling productivity] will prop up unit labour cost growth and keep services inflation stubbornly high."

While some of the ideas of our AI future might well be fantasy — at least for now — its implementation could have very real societal impacts.

Arguably, one of the most highly desired impacts is a major productivity boost. Describing AI's potential influence over inflation, Blackrock CEO Larry Fink quips:

If AI can reach the levels of our imagination just think what it could do. It will change how we work. It would change our productivity. This could be the key that brings down inflation.

Does this all mean ASX artificial intelligence shares are a 'must-have' in the portfolio?

We'd likely need to consult a crystal ball to truly answer such a question. However, some reflection upon past tech booms could serve as valuable introspection.

Are ASX artificial intelligence shares in a mania?

A roll call of the biggest AI boomers on the ASX so far this year includes:

- WiseTech Global Ltd (ASX: WTC), up 63%

- Volpara Health Technologies Ltd (ASX: VHT), up 32.7%

- NextDC Ltd (ASX: NXT), up 43.7%

- Appen Ltd (ASX: APX), up 18.2%

All of the above AI-exposed companies have generated returns exceeding the S&P/ASX 200 Index (ASX: XJO) this year. Yet, their gains are still a far cry from the colossal moves made by their US counterparts. Even further still from the market-melting heights displayed by tech companies during the dot-com bubble.

The apparent disconnect between gains in ASX artificial intelligence shares and others worldwide could be a siren song for investors. For those tempted to dive in on the trend, Motley Fool equity research analyst Andrew Legget provides a word of caution, stating:

It is important for investors to remain cautious in my opinion. We are still in the really early stages of even understanding artificial intelligence let alone how it can be best used.

There is a good chance that a lot of the 'AI' speak we see today is seen in hindsight as a lot of hot air. I wouldn't be basing any investment decision, for any company, at the moment solely on artificial intelligence.

Amid the rapid unfurling of this emerging technology, the importance of applying fundamental analysis is critical. The investors worst affected by the popping of the dot-com bubble were those holding companies with no proven business, no revenue — just a website.

That isn't to say AI is necessarily in a bubble now. In fact, in retrospect, the future may tell us that we undervalued the potential all along.

What everyone should do is evaluate companies, of all sorts, on their own merit. Warren Buffett — arguably the greatest investor of our lifetimes — made his billions by investing in businesses, not trends.