I'll be the first to admit, researching ASX mining shares is not my strong suit. The world of assays and resource estimates sits far outside my circle of competence.

Though, I still sometimes find opportunities in the industry and size my investment (mindful of my minimal knowledge) accordingly. This approach has served well, leading to rewarding holdings in Albemarle Corporation (NYSE: ALB) and Lynas Rare Earths Ltd (ASX: LYC) in the last few years.

This week, another mining company has sprung onto my list, catching my eye in a similar fashion to those that have come before it.

Which ASX mining share am I watching?

I recently stumbled upon a small manganese miner during my routine sifting through ASX companies.

For the uninitiated, manganese is a metal predominantly used as an alloy in steel to improve its material properties. More recently, the metal has found demand in its application within electric battery cathodes.

Standing at a market capitalisation of $421 million, Jupiter Mines Ltd (ASX: JMS) is not an ASX mining share that is discussed all too often. Although, the reality is the number of mentions in the media holds little correlation to the likelihood of wonderful returns.

Instead, there are a few fundamental reasons why I think Jupiter Mines could be a stealthy opportunity.

What makes it appealing?

There are two facets to consider when assessing Jupiter Mines: industry-wide (top-down) and company-specific (bottom-up). Let's first take a look at the top-down considerations, before diving into the nitty-gritty of this manganese miner.

Top-down

The overarching story here, in my view, is the market may not be factoring in the potential for a prolonged manganese shortfall.

Currently, more than 90% of manganese demand is driven by steelmaking, which is expected to weaken in conjunction with slowing economies. However, continued appetite for electric vehicles could actually end up outstripping supply — supporting, if not increasing, manganese prices.

Earlier this year, some industry participants warned that high-purity manganese supply could fall into deficit by 2024.

At present, manganese is used in small quantities to stabilise the cathode in lithium-ion batteries. But, what happens if Tesla Inc (NASDAQ: TSLA) and others decide to use more manganese to reduce the amount of cobalt?

Even without this, the incredible growth forecast for EVs and battery storage could drive much higher prices for the lesser-known metal.

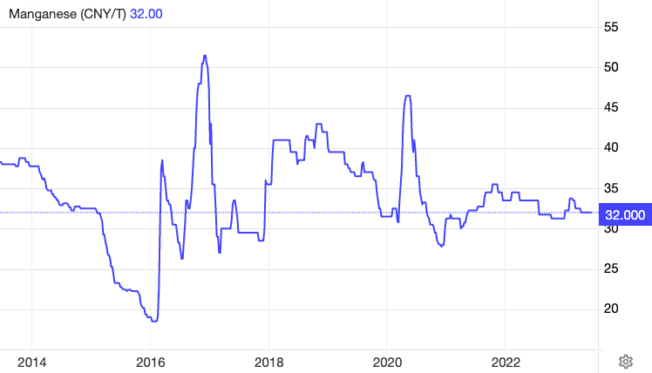

Yet, manganese prices have mostly traded sideways, as shown above, while the likes of lithium and rare earths have boomed. This leads me to believe that the supply and demand imbalance has not materialised to date, likely failing to incentivise new projects.

Bottom-up

Now comes the hard, but important, question: why pick Jupiter Mines of all the ASX manganese mining shares?

Jupiter Mines owns a 49.9% interest in the Tshipi open-pit manganese mine in South Africa — which is located adjacent to South32 Ltd's (ASX: S32) Mamatwan mine. Both are placed in the Kalahari Manganese Fields, believed to be the largest manganese-bearing formation in the world.

Tshipi, itself, has a strong track record of delivering on its goal of producing 3 to 3.6 million tonnes per annum (mtpa) of manganese ore. Additionally, the mine has been able to meet this target while maintaining a low cost of production.

Though, what I find most appealing is Jupiter Mines' price-to-earnings (P/E) ratio of 5.4 times. Meanwhile, the Tshipi mine is estimated to still have more than 100 years of mineable resource remaining.

Hypothetically — assuming earnings remain flat, and Jupiter Mines is able to maintain a payout ratio of around 60% — in approximately nine years I will have made back in dividends what I originally invested. The following decades — assuming resource estimates are correct — would be pure profits on my investment.

Next move

Don't get me wrong, there are still plenty of risks. For instance, Jupiter Mines is completely reliant on the price of manganese. Whereas other ASX mining shares, such as South32, are diversified across several metals. Similarly, the company has all its eggs in one basket geographically.

Moreover, there are other, more established mining companies trading on similar earnings at the moment. For example, South32 is also trading at 5.3 times last year's earnings. Likewise, iron ore behemoth Fortescue Metals Group Ltd (ASX: FMG) is perched at 7.4 times earnings.

Nevertheless, I personally think Jupiter Mines is an interesting proposition given the combination of manganese demand, a low earnings multiple, and an extremely large resource. At the least, I think it could find its way onto South32's acquisition shortlist at a substantial premium to today's price.

In the meantime, I will be running the ruler over this ASX mining share again to ensure I haven't overlooked any dealbreakers.