Transurban Group (ASX: TCL) shares were added to the Aussie bourse in 1996, providing notable returns for investors who jumped in early.

Stock in the toll road operator rocketed more than 350% in the 20 years to mid-2019.

However, shareholders have likely been left disappointed in recent years.

Amid plenty of ups and downs – and a global pandemic – Transurban shares have ultimately traded flat over the four years since.

Could the company be gearing up to post ripper returns in the future? Or is the S&P/ASX 20 (ASX: XTL) icon worth bypassing?

We asked two of our Foolish team whether they are bullish or bearish on Transurban shares and received two very different responses. Here's what they had to say.

A dual carriageway towards income and stability

By Brooke Cooper: As a long-term investor, I think Transurban shares could be a worthwhile buy for the years to come, and I have three reasons as to why.

The first is the company's defensive qualities.

A defensive stock is one that isn't largely impacted by broader economic cycles. Thus, their income tends to stay stable through hard times and good ones.

Transurban fits into this camp as road users typically don't avoid driving on toll roads, even when they're feeling the pinch. In fact, the company posted record traffic in the first half.

The company's income is also hedged from inflation.

The fees drivers pay to use the majority of Transurban's toll roads are directly linked to inflation. That means when inflation rises, so too does the company's revenue.

Thus, Transurban can feasibly provide some inflation protection to a share portfolio too – an important factor to consider when investing for the long term.

Also important in the face of inflation is looking at a company's balance sheet. In this regard, Transurban looks solid.

It boasts plenty of flexibility, with $3.6 billion of corporate liquidity and 97% of its debt book fully hedged.

The third factor that leaves me feeling positive on Transurban shares is the company's historical dividend growth.

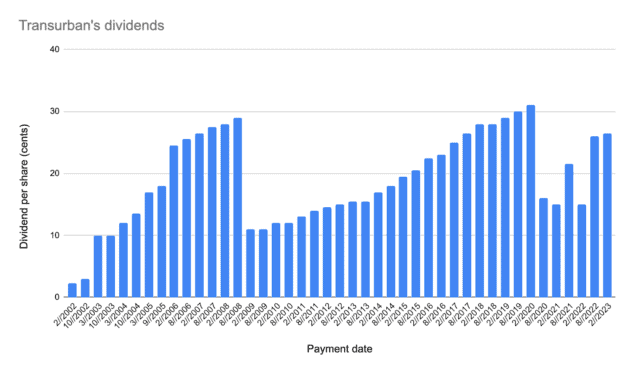

Its dividends dropped in financial year 2009 when it moved to better align its payouts with its cash flows and again in financial year 2020 and financial year 2021 amid the COVID-19 pandemic.

Aside from those two instances, the company has posted impressively consistent dividend growth, as the below chart shows (the vertical axis represents dividends per share in cents).

And that's set to grow further in financial year 2023. The company upgraded its distribution guidance last month, forecasting it will offer 58 cents per share this fiscal year – a 41.5% year-on-year increase.

That suggests its final dividend will come in at 31.5 cents, which would represent a new record.

Of course, the elephant in the room is that the Transurban share price could currently be deemed a tad expensive. It closed trading yesterday at $14.31. Despite that, I personally think the stock is worth looking at as a long-term investment.

An unimpressive share that doesn't excel at anything

By Sebastian Bowen: Transurban is a fine company. But I argue it is set to deliver some fairly average returns for investors going forward.

Most investors buy Transurban shares for the dividend — and the company's reputation as one of the safest and most secure income streams on the ASX. But right now, the dividend yield is sitting well under 4%.

You can get a far better yield on your cash from almost any other share in the top echelons of the ASX. Indeed, Telstra Corporation Ltd (ASX: TLS), Commonwealth Bank of Australia (ASX: CBA), BHP Group Ltd (ASX: BHP), Westpac Banking Corp (ASX: WBC), National Australia Bank Ltd (ASX: NAB), and Woodside Energy Group Ltd (ASX: WDS) all offer higher dividend yields than Transurban at the present time.

And, unlike Transurban's payouts, these dividends tend to come with full franking credits. Transurban's shareholder payments rarely come franked at more than 10%.

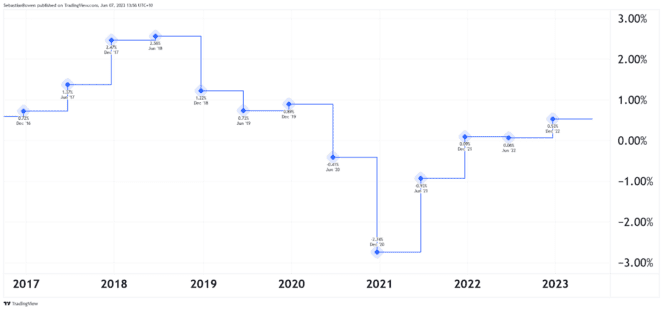

It's not just the dividends that I have a problem with. Transurban is not a company that compounds money at a high rate. In fact, its return on investor capital over the past few years hasn't even broken above 2%:

Its return on equity (ROE) is even worse than that, averaging just 0.15% over 2022.

But despite these lacklustre statistics, the Transurban share price tends to trade at some pretty expensive valuations. On recent pricing, the company has a trailing price-to-earnings (P/E) ratio of almost 270, and a forward P/E ratio of 97.1.

It also had a price-to-sales (P/S) ratio of 10.88, and a price-to-book (P/B) ratio of 3.34. That latter figure means Transurban has a market capitalisation of more than three times the underlying value of its assets.

And while Transurban's toll roads do provide some protection against inflation, this protection is arguably nullified by the company's heavy debt. This debt burden means that if interest rates are high, the company's costs can increase substantially. This, in turn, can effectively negate its inflation-linked tolls.

So all in all, I think Transurban is a fine company. But its current share price gives it a relatively low dividend yield and a massive valuation compared to the underlying fundamentals of what is a fairly uninspiring business.