Westpac is one of the largest banks in Australia. It also claims to be the first bank and oldest company in Australia, tracing its roots back to 1817 when the Bank of New South Wales was established. The bank operates a multi-brand strategy that includes Westpac, St.George, Bank of Melbourne, BankSA, BT, and RAMS.

The Westpac Banking Corporation (ASX: WBC) share price has floundered in 2023 so far, as seen on the chart below.

But does this present an opportunity to buy up Westpac shares, or does it signal tough times ahead amid tightening lending conditions?

We posed this question to two of our team, each with opposing views on the outlook for the banking giant. Read on to uncover the bull and bear cases for Westpac shares.

A cheap valuation combined with big dividends

By Tristan Harrison: The Westpac share price is now much cheaper than it was in February 2023, down more than 10%.

But this comes at the same time the bank is reporting much stronger profit. In fact, the bank's FY23 half-year net profit after tax (NPAT) rose by 22% to $4 billion. I like that the bank is significantly improving its cost-to-income ratio, improving profitability.

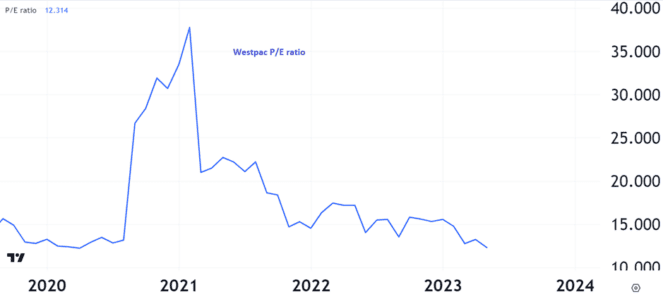

Source: TradingView, Westpac's price/earnings ratio

On the chart above, we can see that AUSTRAC proceedings and COVID-19 impairments hurt profit in the FY20 result, released at the end of 2020. Back then, the Westpac share price was high for how low the profit was. Today, it's the opposite — the bank's shares have dropped despite Westpac making a lot more profit.

It's fair to say there's a danger Westpac's earnings may be about to decline from mortgage and deposit competition, and possibly higher impairments from households and businesses struggling with making loan repayments.

But, the ASX bank share's loan book is holding up. In its FY23 half-year result, Westpac revealed the percentage of mortgages overdue by at least 90 days actually dropped one basis point to 0.68% of total mortgages. Westpac described its quality as "sound".

So, what can we look at to say whether Westpac shares are good value or not? The price-to-book ratio tells investors about a company's market capitalisation compared to the value of its balance sheet.

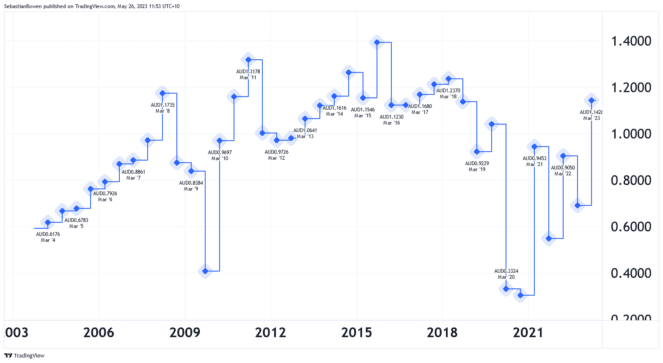

As we can see on the chart below, Westpac's price-to-book ratio has been steadily getting cheaper over the last decade. In fact, it's almost the cheapest it has been since 2020. There's a general guideline for bank investing that suggests a bank is good value if its price-to-book ratio is 1x or less. We're at that level for Westpac shares.

Source: TradingView Westpac's price-to-book ratio

Finally, Westpac's projected dividend yield could boost shareholder returns nicely. Commsec numbers suggest a grossed-up dividend yield of 9.6% in FY23 and 9.8% in FY24, though these payments are not guaranteed.

A mediocre bank that has always been mediocre

By Sebastian Bowen: Westpac is a popular share, especially beloved by ASX dividend investors. But I argue that it has been a poor performer for long-term shareholders, and will probably continue to be.

Australia has a rather strange and unique banking system. For decades, the government held to the 'four pillars' policy, which essentially allowed Westpac to avoid becoming a takeover target of other, larger ASX banks. Today, it ranks as the ASX's third-largest bank, behind Commonwealth Bank of Australia (ASX: CBA) and National Australia Bank Ltd (ASX: NAB).

Yes, Westpac is one of the oldest companies in Australia. But it has barely changed in size over the past 17 years. Back in 2005, you could buy Westpac shares for about the same price they are going for today. And no, Westpac hasn't done any stock splits that would justify this situation. So that's my first red flag.

A company's share price typically follows its earnings higher or lower over time. So it's no surprise to see that Westpac's basic earnings per share (EPS) has been stagnant for more than a decade, as you can see below:

Source: TradingView Westpac's basic earnings per share (EPS)

What investors typically like to see is the kind of growth the business was sporting between 2004 and 2008. Not the water-treading we have seen since 2008. Even giving Westpac a free pass for COVID-ravaged 2020 and 2021 doesn't alleviate the problem on display here.

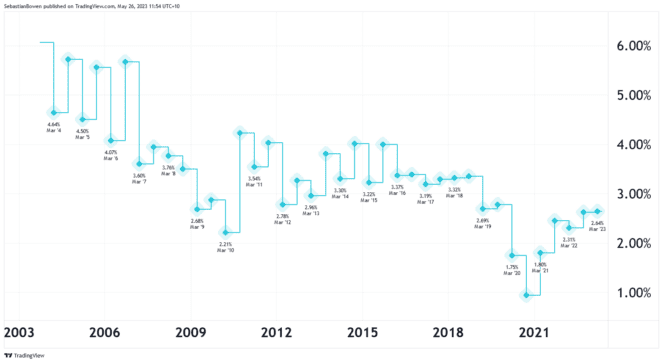

It's clear that Westpac is a rather mediocre business. Just take a look at its return on invested capital since 2003:

Source: TradingView Westpac's return on invested capital (%)

As you can see it has been steadily falling over the past decade and, most recently, sits at a fairly uninspiring 2.64%. You could get a better return from a Westpac savings account than what the bank has been getting from its capital in recent years.

Don't get me wrong, Westpac is a comfortably profitable and mature business that isn't going anywhere anytime soon. But it has been an exceptionally poor performer over the past decade-and-a-half, and I don't see anything that tells me that Westpac will turn things around.

This mediocrity is probably why the company is trading on such a cheap price-to-book ratio at present.

So, in my view, Westpac is worth a look if you're after a significant dividend, but not for much else. Remember the wise words of Warren Buffett: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."