The market responded unforgivingly to the latest figures from National Australia Bank Ltd (ASX: NAB). Shares in the banking major are now down more than 9% since entering 2023, despite a continued uptick in earnings.

In light of the reaction, we asked two of the Foolish team to explain the bull and bear stance for this ASX bank share.

Here's what they had to say.

Why I won't be buying NAB shares

By Mitchell Lawler: The NAB share price has been the worst-performing of the big four banks over the past year, with its share price falling 15%. Strangely, this underwhelming performance has occurred while net interest margins (NIMs) have expanded amid rising interest rates.

After a boom period for profits, investors will be looking to what comes next. I think the next year or so won't be as fruitful as the last. I'm rarely pessimistic, but the outlook appears mediocre at best for ASX bank shares whichever way you slice it.

Credit quality will be tested across all forms of lending if the Reserve Bank of Australia determines rates need to go higher for longer. Meanwhile, if rates begin falling, we're likely to see a reduction in NIM. Both ways, the outcome is most probably lower earnings for the big banks.

In my opinion, Macquarie Group Ltd (ASX: MQG) is a much higher quality alternative to NAB shares. Both trade on earnings multiples of around 12 to 13 times, however, Macquarie is less reliant on banking and financial services.

Furthermore, Macquarie has a history of delivering a greater return on equity (ROE) than NAB. The investment bank's ROE has been trending higher since 2015. In contrast, NAB has been unable to deliver a return on equity above 13% and trending sideways.

Lastly, as competition remains stiff between the big four, keeping expenses in check will become more critical.

Out of the four, NAB let its expenses blow out the most compared to the prior corresponding period (pcp), according to the latest round of updates. Total expenses grew by 11.5% pcp, with the next worst offender being the Commonwealth Bank of Australia (ASX: CBA), up 5% pcp.

The considerable jump in costs is another reason why I am not on board with buying NAB shares at this point in time.

Motley Fool contributor Mitchell Lawler does not own shares in National Australia Bank Ltd

Heated competition beginning to settle

By Tristan Harrison: The NAB share price has declined close to 20% since February 2023, despite reporting an impressive 17% rise in cash earnings in the first half of FY23.

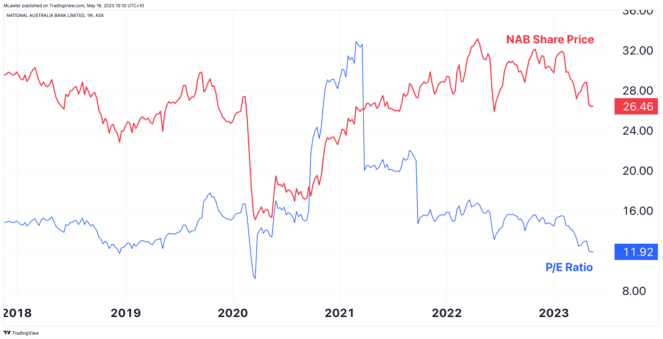

This has led to the NAB price-to-earnings (P/E) ratio being the lowest it has been since the COVID-19 crash.

We can see on the chart below that the (blue) P/E ratio line generally tracks the (red) share price line. But, while the NAB share price briefly dropped lower last year, it's at the lowest earnings multiple because of its higher profits.

So, the key question is: will earnings hold up?

There has reportedly been intense competition in the banking space, which has been lowering the net interest margin from its potential peak after the run of interest rate rises.

However, we've recently heard the home loan battle could soon be softening, with NAB (and Commonwealth Bank of Australia) ending cash-back offers at the end of June.

This could be a very promising step for NAB's NIM and overall profitability if it doesn't need to compete as hard to retain and win customers.

In the meantime, NAB's business bank continues to perform very well. During HY23, the bank's business and private banking division saw a 20% increase in cash earnings to $1.7 billion. It was NAB's most profitable division and saw a big improvement in profit.

NAB's profit doesn't need to grow much for NAB shares to do well from here, partly because the lower valuation has boosted the grossed-up dividend yield to 9% for FY23, according to Commsec.

I also think the bank can continue to perform well through this uncertain period under the stewardship of skilled banker and CEO Ross McEwan.

Motley Fool contributor Tristan Harrison does not own shares in National Australia Bank Ltd