On my hunt for serial compounders, ResMed CDI (ASX: RMD) shares have made their way onto my watchlist. The company's share price has flown 16.4% higher since the beginning of the year, but that's not why the respiratory medical device maker is on my radar.

The real eye-catching aspect of ResMed is its push into a potentially lucrative revenue stream. While there are notable differences, ResMed appears to be executing a play that's arguably been instrumental in the success of Apple Inc (NASDAQ: AAPL) over the past decade.

So, do I think this growth ingredient is enough to justify the 40 times earnings multiple ResMed shares are fetching?

What is the money-making Apple move?

Most of us know the American tech giant for its sleek and intuitive devices — iPhones, iPads, Macs, etc. These innovative and stylish products have formed the backbone of Apple's sticky ecosystem as we know it today.

Over time, Apple has embedded itself in the daily lives of its customers, selling products that many of us use day in and day out. In doing so, the company has built up enormous switching costs, which is a type of moat. Financially, it's hard to justify swapping to a non-iPhone when it means also shelling out for a new smartwatch, wireless headphones, etc.

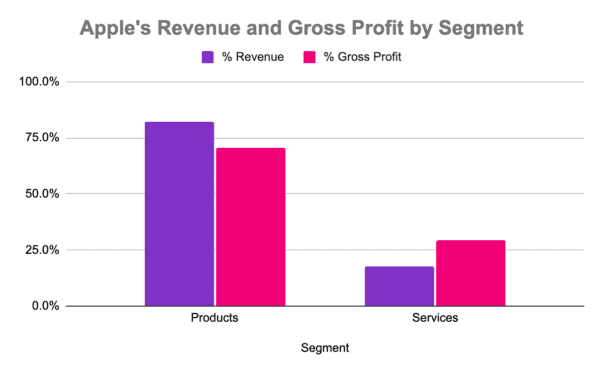

While the company's, almost luxury-like, devices generate solid profits, it is the services segment that takes full advantage of the high switching cost.

This segment extracts extremely high-margin revenue from the Apple customer base by monetising the limited number of alternatives (of which there are none at times) to iCloud, the App Store, and Apple Pay among others.

The chart above illustrates how the services segment delivers an outsized boost to gross profits compared to its share of revenue. Simply put, the near-zero cost of providing services — which are mostly just a bit of software — makes this avenue a lucrative one.

Could SaaS revenue make ResMed an ASX 200 outperformer?

Like Apple, ResMed is best known for its physical products. For many, the company's medical equipment is essential for getting a good night's sleep — combating sleep apnea and insomnia with their continuous positive airway pressure (CPAP) machines.

However, ResMed has been quietly building another source of revenue… Software as a Service (SaaS). What is noticeably different from Apple is that it appears most of this revenue is derived from clinical-facing software rather than consumer-facing.

At present, ASX-listed ResMed's solutions encompass Brightree, MatrixCare, Healthcarefirst, CitusHealth, and Medifox Dan. Generally, these solutions are geared towards streamlining processes for healthcare workers.

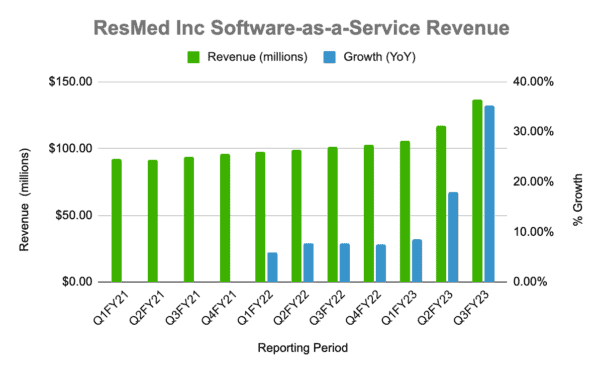

Nevertheless, the segment has grown rapidly in recent years. Between Q3FY21 and Q3FY23, SaaS revenue increased 45.8% to $136.8 million. Still, this fast-growing division only represents roughly 12% of total revenue.

Where ResMed possibly departs from Apple's storyline is its relationship between the software/services and its key products.

Personally, I'd be more excited if ResMed leveraged its SaaS expertise to derive higher revenue from its medical device customers. Perhaps that is the endgame of the ResMed team. From my perspective, that would make use of the high switching cost of its products, implementing the Apple strategy.

Until then, ResMed will probably stay on my ASX watchlist.