TPG Telecom Ltd (ASX: TPG) landed on the ASX in July 2020 as a result of the merger between Vodafone Australia and TPG.

The combined business instantly became the third-largest telecommunications provider in Australia.

So after three years of public trading, are TPG shares now worth buying into?

Why TPG shares could be a good buy

By Tristan Harrison: The TPG share price has been on a solid run over the past month, rising by around 10%. That compares favourably to the S&P/ASX 200 Index (ASX: XJO) which has only gone up by 1%. I think its total returns can keep outperforming over the next few years.

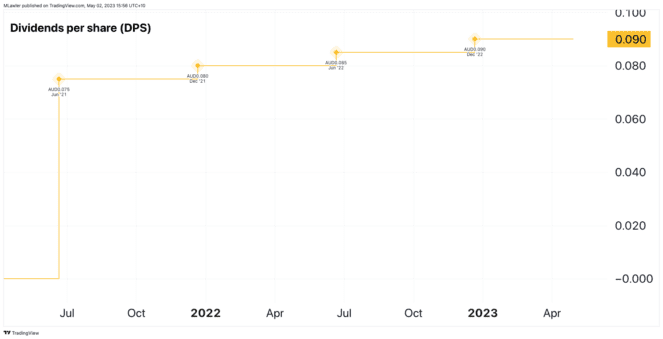

The ASX telco share has steadily grown its dividend each year since it was listed a few years ago and is expected (according to Commsec numbers) to keep growing the dividend to FY25. That FY25 payment could be 21 cents per share, which would be a grossed-up dividend yield of 5.5%.

The earnings per share (EPS) is also predicted to increase in FY24 and FY25, which could be a positive factor for the TPG share price.

A lot of the smaller competitors have been acquired, or merged, with the larger players in recent years. This may be why Telstra Corporation Ltd (ASX: TLS) is willing to increase prices significantly. If rivals are increasing prices, TPG may be able to attract customers with better value. Or TPG could keep increasing prices to improve its profit margins.

TPG is seeing an increase in subscribers, gaining 300,000 subscribers in the 2023 financial year. It's also working on reducing costs as part of the synergies between the merger of TPG and Vodafone Australia.

While it may not be the strongest performer in the next 12 months, I think it can beat the returns of the ASX 200 thanks to its growing subscribers and defensive earnings.

Motley Fool contributor Tristan Harrison does not own shares in TPG Telecom Ltd.

Heading down while rivals are heading up

By Tony Yoo: TPG Telecom shares have, unfortunately, been nothing but a disappointment since they listed on the ASX.

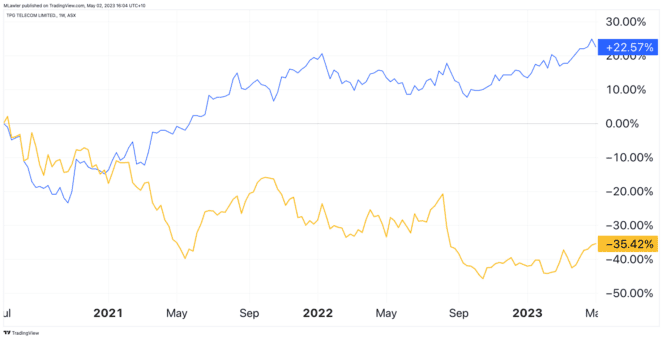

The stock price is down more than 36% since its first-day closing price, even though industry conditions have become more favourable.

The telco sector has consolidated over the past few years, meaning the days of loss-leading sales are largely over. Many of the smaller players have been bought out by the bigger fish, such as when Optus acquired Amaysim.

The merger between Vodafone and TPG itself was part of this trend.

Don't get me wrong – mobile phone and broadband retailing are still very commoditised. The services are almost a utility these days, similar to water and electricity.

But it's a far more rational market now than it was a few years ago, when telcos went broke to sign up customers.

TPG Telecom, however, has failed to take advantage of the better business environment, losing market cap while the Telstra share price has rocketed more than 30%.

Speaking of Telstra, investors must take note that the telco industry is one that is capital-intensive.

This places smaller players at a more pronounced disadvantage than other sectors. Telstra and Optus simply have deeper pockets than TPG to invest in and maintain infrastructure.

Finally, the man who founded TPG and grew it from a small computer shop to a telco giant, David Teoh, exited the merged entity in 2021. An executive with that type of growth experience is not easy to replace, and the company is no longer a "founder-led business".

Hence I would not buy TPG shares right now.

Motley Fool contributor Tony Yoo does not own shares in TPG Telecom Ltd.