Trawling through shares in the S&P/ASX 200 Index (ASX: XJO), we can at times forget what actually creates wealth for shareholders in the long run.

While the share price moves arbitrarily in the short term, the decisions on how to invest company capital are what truly drive value creation over a prolonged holding period. You won't find many businesses sustaining their existence if tipping in $1 means getting 20 cents in return — that's fundamentally what return on capital employed (ROCE) measures.

In simplistic terms, return on capital shows investors how profitable and capital efficient a company is. Unlike return on assets or return on equity, ROCE takes into account both debt and equity for funding operations, providing a more complete picture.

All that's left to do now is find out which ASX 200 shares ranked the best and worst at providing a return on their capital.

Wizards of capital deployment

Before we get underway, it's probably helpful to provide a baseline to put the following data into perspective. A 20% return on capital is generally considered 'good'. Though, this differs from industry to industry.

Popping the locks on the highest return on capital across ASX 200 shares over the past year, we are inundated by commodity-focused companies.

Although many commodities — such as lithium and coal — have drastically retreated recently, these materials are still fetching prices far above historical averages. As long as expenses haven't grown at the same rate, the outcome is boosted returns on capital.

The index constituents taking out top spots on the podium are listed in the table below:

| Company | Return on capital | Market capitalisation |

| Deterra Royalties Ltd (ASX: DRR) | 250.4% | $2.55 billion |

| Pilbara Minerals Ltd (ASX: PLS) | 76.0% | $11.96 billion |

| Whitehaven Coal Ltd (ASX: WHC) | 68.1% | $6.12 billion |

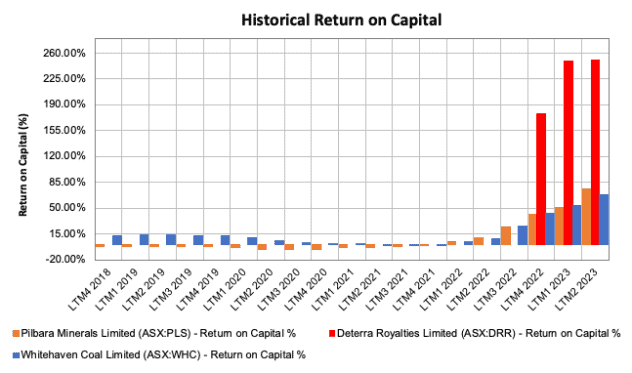

By digging up historical return on capital data for these three ASX 200 shares, it becomes even more evident that the face-melting returns are only a recent feature of these particular companies.

Prior to commodities booming, Pilbara Minerals and Whitehaven Coal were achieving subpar returns on capital, as depicted below.

Boasting a return on capital percentage above 175% for three years running, Deterra Royalties is an extreme outlier among the bunch. We can attribute this to the lucrative business model of royalties.

Once royalty rights are acquired, there is very little in the way of additional capital needed to derive considerable profits.

ASX 200 shares igniting capital

Unfortunately, not every company's capital efficiency is as healthy.

Whether through poor choices or playing the long game, many ASX-listed companies are pouring capital into the engine to no avail — at least not in the past 12 months…

The worst returns on capital among ASX 200 shares are the following:

| Company | Return on capital | Market capitalisation |

| Telix Pharmaceuticals Ltd (ASX: TLX) | -96.1% | $2.97 billion |

| Brainchip Holdings Ltd (ASX: BRN) | -60.6% | $777.8 million |

| Chalice Mining Ltd (ASX: CHN) | -32.7% | $3.01 billion |

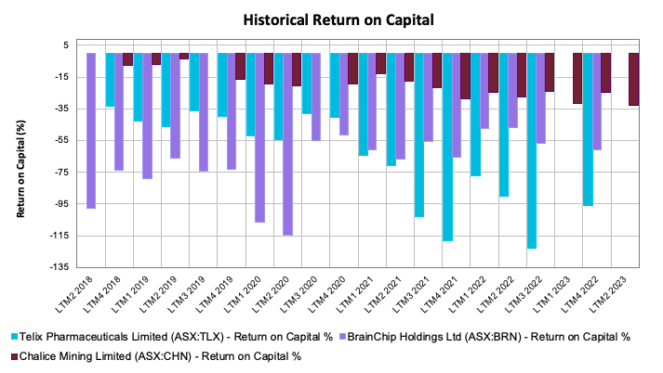

There's a common denominator between the three poorest performers — all of them are still exploring.

While Telix Pharmaceuticals is exploring new cancer detection methods and treatments, Chalice Mining is exploring for more minerals in Western Australia. Meanwhile, AI-chip developer Brainchip is exploring new technologies.

The process of exploration for any company comes at a high cost. If the business does not already have a profitable revenue source, the return on capital suffers.

A quick look at the historical return on capital data for the worst names on the list shows a track record of chewing up capital, as shown above.

However, this doesn't mean these ASX 200 shares can't be wealth creators in the future. For example, Telix's trailing 12-month revenues have surged to $160 million from $7.6 million in the space of one year. Additionally, the company recently reported its second consecutive quarter of positive cash flow.

Foolish takeaway

It can be interesting to look at which companies are posting great, and not-so-great, returns on capital as of right now.

Despite the usefulness of this fundamental metric, it's important not to necessarily invest in certain ASX 200 shares purely based on the latest return on capital figures. I say this because the metric can change over time, and what is wildly capital efficient at present may not be five years from now.

The key is to identify those few high-quality companies that could deliver consistently high returns on capital. As they say, consistency is key, as opposed to a one-hit-wonder.