It has been the School of Hard Knocks for Kogan.com Ltd (ASX: KGN) shareholders for the past couple of years. After surging to nearly $25 apiece amid insatiable online demand during the pandemic, Kogan shares have taken the painful trek back down.

A stretch of unprofitability has left a sour taste in the mouth of investors. Rather than sticking around to see when the tides will turn, many have decided to cash out. As a result, the online retailer's share price has fallen 31.5% over the past year, as displayed in the chart above.

Kogan shares closed at $3.53 apiece on Monday.

What matters now is whether Kogan can regain its appeal or if its heydays are well and truly behind it. To unpack the merit behind both sides, two of our writers have picked up their pens to participate in a mental joust.

Here is the outcome of the Kogan bull vs. bear battle:

Not running to the checkout for this online retailer

By James Mickleboro: I've been bearish on Kogan for some time and am certainly glad I stayed well away from its shares.

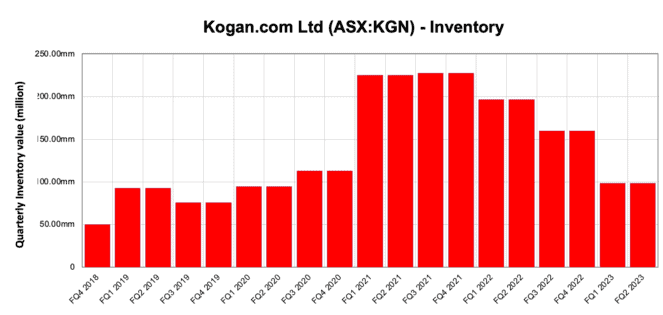

The e-commerce company's disastrous inventory management over the last 18 months destroyed significant shareholder wealth and has me doubting its ability to scale successfully. Especially in the face of increasing competition from one of the world's largest companies.

For a long time, Kogan was touted as Australia's Amazon. However, I firmly believe that the Amazon of Australia will be Amazon itself. You only need to look at the contrasting performances of the two companies to see this.

Last year, when Kogan's sales were going backwards as customers returned to brick-and-mortar retail stores, Amazon Australia's sales grew by almost 50% to $2.63 billion.

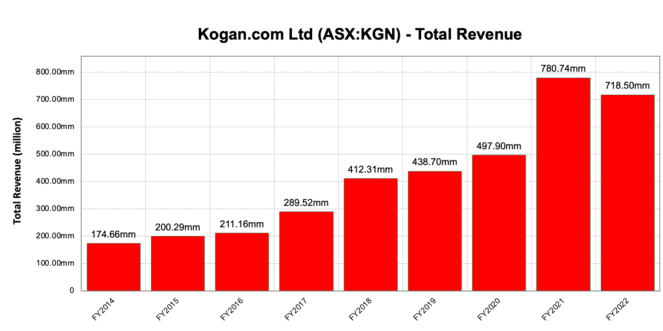

Let that sink in for a second. Amazon officially launched in Australia in December 2017. Since then, it has gone from zero to $2.7 billion in five years. Whereas Kogan has gone from approximately $290 million in FY 2017 to $718 million in FY 2022 (shown below). At the same time, Amazon Australia has grown its offering from 75 million products to 200 million. I don't believe this bodes well for Kogan's future.

In addition, with the Amazon Prime service offering free next-day delivery (even on a Sunday!) and a streaming service to rival Netflix for just $6.99 a month, I believe its value proposition is compelling for consumers. And while Kogan has its own loyalty program, Kogan First, the benefits pale in comparison and won't see me cancelling my Prime membership any time soon.

There's a saying that every dog has its day. And while eventually, value can be found in most ASX shares, I don't see any in this dog. For example, according to CommSec, the consensus estimate is for Kogan to deliver earnings per share (EPS) of 10 cents in FY 2025.

This means its shares are changing hands for 37x FY 2025 earnings. As a comparison, fellow retailer Accent Group Ltd (ASX: AX1) trades at just over 14x forecast FY 2025 earnings. That's despite Accent being the clear market leader in its category!

Overall, in light of the above, Kogan shares won't be making an appearance in my portfolio any time soon.

Motley Fool contributor James Mickleboro does not own shares in any shares mentioned.

Why add Kogan shares to the cart?

By Tristan Harrison:

The Kogan share price has fallen significantly since the COVID-19 hype, and I think it's now at a point where the business can rebound and deliver positive returns.

Kogan sells a wide range of products, but it also offers customers a number of extra services, including mobile, energy, insurance, and internet.

The first part of the COVID-19 period saw the business experience extraordinary levels of demand. But, a lot of things have gone wrong since then.

However, the business seems to be on the right course again. It said that it returned to profitability in adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) terms in January 2023, the first profitable month since July 2022.

The business has 'right-sized' its inventory — as depicted below — and it's expecting to achieve further operational efficiencies in the second half of FY23 as a result of that inventory improvement.

I think that the market underestimates how much profit the company can make once normal operating conditions return. Remember that in FY19, it made $17.2 million of net profit after tax (NPAT), so if it can just recover back to those profit margins, I think it can do well.

Kogan has increased its market presence since then, meaning increased scale, with the acquisition of (profitable) Mighty Ape. This has enabled it to expand into New Zealand.

More people are going to buy products online in the future as more people adopt online shopping. I think Kogan can benefit from that trend while hopefully experiencing increasing profit margins if it sees scale benefits.

Motley Fool contributor Tristan Harrison does not own shares in Kogan.com Ltd.