When it comes to building wealth through investing, there are few strategies more effective than compounding. By reinvesting your dividends, you can harness the power of compounding to grow your portfolio over time. But not all ASX dividend shares are created equal.

Identifying companies that can stand the test of time should be a priority if building life-changing wealth over decades is the plan. There's little point in finding an investment with a high yield now if it goes bust five years later — undoing all of the prior compoundings.

That's why I would focus on companies within the ASX 300 with a competitive edge and a long history of growing dividends.

Let's take a look at three companies that I believe best fit the bill.

Retailers with strong and growing brands

The accumulated value of a brand built over decades can be a wide and defendable moat. Humans tend to unconsciously gravitate toward companies they know and trust, even if it means sometimes paying more than at a lesser-known competitor.

Two dividend shares I reckon are prime examples of this familiarity bias in action are Super Retail Group Ltd (ASX: SUL) and Premier Investments Limited (ASX: PMV). Kicking off in 1972 and 1987, respectively, both companies have a long track record of providing quality products at affordable prices.

While growing their customer bases over the years through additional stores and brands, these two retailers have amplified their earnings. Similarly, dividends have gradually trended higher during their listed lives, as shown below.

Aside from Super Retail Group experiencing a blip during the pandemic, dividends have steadily increased over time.

In my opinion, both Premier Investments and Super Retail Group have a good chance of compounding into the future. This is because both of these ASX dividend shares are still rapidly growing their brands.

For example, Super Retail achieved 55% sales growth of its Macpac brand in the first half of FY2023. Likewise, Premier Investments revealed record half-year results today. The retail conglomerate's global sales of its Smiggle brand increased 30.3%, and Peter Alexander's sales reached a record $261.7 million — up 15.1% year on year.

Possible future dividend aristocrat inside the ASX 300

The crème de la crème of the compounding is a dividend aristocrat — companies that have upped their dividends for 25 consecutive years or more.

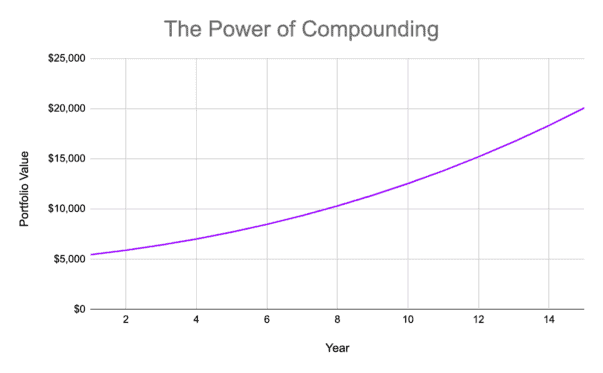

Even an initial investment of around $5,000 can grow to considerable wealth over 15 years, assuming the company increases its dividends by roughly 10% per annum and the share price rises 5% each year.

Assuming dividends are reinvested, such a hypothetical investment could grow to more than $20,000, as illustrated below.

Unfortunately, there aren't any ASX 300 shares — or ASX companies, period — that meet the stringent criteria of an aristocrat. However, if we loosen the conditions to include ASX shares that have not reduced their dividends over the same time, Sonic Healthcare Limited (ASX: SHL) gets pretty close.

The laboratory and pathology giant has not once cut its dividends over 20 years. An exceptional history if ever I've seen one.

I believe Sonic's positioning in a defensive market bodes well as a multi-decade investment. The company's strong balance sheet and involvement in molecular diagnostics could fuel future years of compounding, in my opinion.