The Novonix Ltd (ASX: NVX) share price has found itself on the back foot today. Today's move comes amid a handful of recent developments that could be acting as an anchor on investor sentiment.

As we head into the afternoon, shares in the battery technology company are down 6.3% to $1.49. This negative turn places Novonix's shares marginally above the 52-week low of $1.39. Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is only a touch lower than yesterday.

Let's wade through what could be invoking the woeful performance today.

Pressure on to scale faster or lose tech moat

Tesla held its 2023 Investor Day this morning, providing insights into how the electric vehicle (EV) maker plans to procure the materials necessary to deliver on its ambitious goal of selling 20 million vehicles by 2030.

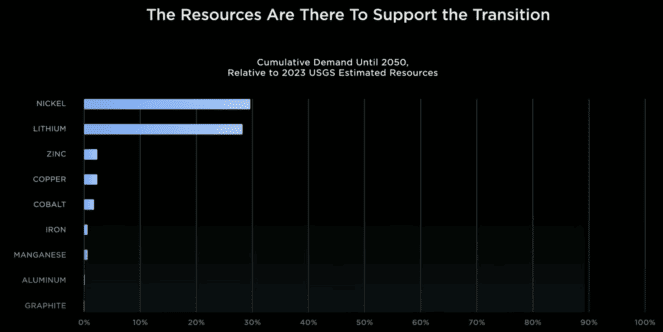

In the eyes of many, the shift to an electrified future has manifested concerns about a shortfall in the supply of lithium and other green metals. Yet, in Tesla's presentation, it was suggested there are ample estimated resources to meet the accumulative demand through to 2050, as pictured below.

Tesla Inc (NASDAQ: TSLA) CEO Elon Musk discussed the real crux of material constraints for the company, stating:

There also seems to be quite a bit of confusion about lithium — lithium is extremely common. It's one of the most common elements on Earth. There's no country that has a monopoly on lithium, or even close to it. There's enough lithium ore in the United States to electrify all of Earth. If the United States was the only place producing lithium, there's enough domestic material to electrify Earth.

The limiting factor is the refining of the lithium into battery-grade lithium hydroxide or lithium carbonate. That's the actual limiting factor.

However, Novonix isn't exactly a 'lithium share', as the company seeks to produce cathodes and anodes from synthetic graphite for use in lithium-ion batteries. Though, this area of the battery supply chain was also discussed during the presentation.

Musk discussed how Tesla is in the process of building its own cathode refining facility, stating:

We are obviously building a cathode processing facility just adjacent to this building […] that's for cathode refining. We'd really prefer it if others did that. We're doing it because we have to, not because we want to.

Furthermore, senior vice president of powertrain and energy engineering, Don Baglino, added:

There just really isn't any large-scale cathode production in the United States and it needed to be done.

This may highlight that Novonix is dragging its feet when it comes to spinning up production at scale. Adding to the issue, Baglino said they would share any process improvements with their supply partners.

Perhaps Novonix shareholders are concerned that Tesla could discover advancements that would minimise the company's competitive advantage.

What else is hitting the Novonix share price?

Novonix released its results for the six months ending 31 December 2022 on Tuesday. The statements showed a continued lack of meaningful revenues, at US$2.7 million for the period. For context, the company brought in US$6.1 million for the 12 months ending 30 June 2022.

The ASX-listed company also reported a US$27.86 million loss. That means Novonix's cash balance was widdled away even further during the half.

Following the result, Morgans moved Novonix shares to a hold with a $1.44 price target.