Dialling in a decent dividend income in 2023 could prove difficult if the pundits are right about an incoming recession. Fewer dollars being spent by consumers could mean fewer dividends for ASX shares to hand out.

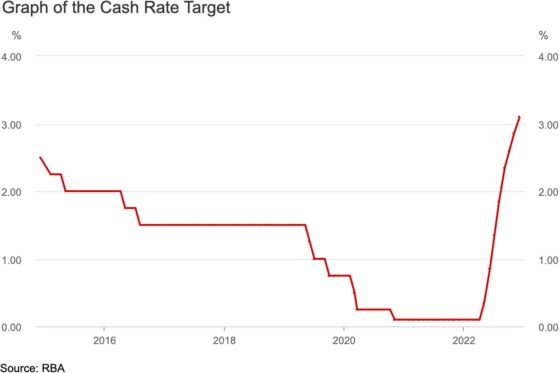

On the other hand, interest rates are estimated to be near their peak. A recent survey of economists conducted by The Australian Financial Review implies two more rises before The Reserve Bank of Australia hits the pause button.

If both were 0.25% increases, we'd be looking at a 3.6% cash rate. In all likelihood, that could mean savings accounts offering around 5%. Not too shabby for a risk-free return on your money.

However, there are two factors to consider before loading up on cash:

- The return would still be negative when adjusted for inflation at the current 6.9% rate; and

- Interest rates are likely to fall again at some point in the future

If all you want is the highest possible yield, these ASX 200 dividend shares are beating inflation and savings rates right now.

Gargantuan ASX dividend yields on offer in 2023

You might initially think you'd need to look outside the S&P/ASX 200 Index (ASX: XJO) for companies advertising a yield greater than 10%.

It sounds too good to be true… something that would be limited to the speculative end of town. Yet, here I am disclosing five ASX shares with the highest yields right now — all above a whopping 10%.

Kicking us off at number five is the global mining beast, BHP Group Ltd (ASX: BHP). Not only has Australia's largest listed company by market capitalisation outpaced the benchmark index by 15% over the last year; but it also touts a tasty 10.1% dividend yield.

Beating out BHP with dividend yields of 11.4% and 12.9% respectively are Tabcorp Holdings Limited (ASX: TAH) and Smartgroup Corporation Ltd (ASX: SIQ). The former enjoyed a 13.7% upwards run in its share price over the past 12 months; the latter suffered a sickening 33% decline.

Smartgroup's mouthwatering 12.9% yield could be in jeopardy in the future following a reduction in the salary packaging and leasing company's interim dividend.

Finally, who are the chart toppers among ASX 200 dividend shares right now? Well, unlike last year, it isn't two iron ore mining companies. Instead, New Hope Corporation Limited (ASX: NHC) and Magellan Financial Group Ltd (ASX: MFG) are the belles of the yield ball.

The New Hope share price (shown above) and dividend yield have exploded since a year ago. Now, investors of this coal producer can bag themselves a 14.8% dividend yield based on the trailing 12 months.

However, the dividend yield champion — Magellan Financial Group — has been dealt a 51% blow to its share price during the last year. But, payouts have remained relatively resilient, boosting this ASX dividend shares' yield to a dazzling 19.2%.