This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Electric vehicle (EV) sales are rising. In 2021, 6.6 million EVs were sold worldwide, nearly double the sales in 2020. EV Volumes, a data base, estimates 2022 global EV sales at 10.6 million, up nearly 60% from 2021. More than 16.5 million electric cars and trucks were on the road in 2021.

Despite such encouraging growth in sales, EV makers' stocks have continued to falter in 2022. Let's see why that was so, and if the stocks look attractive for 2023 after the steep declines.

Top EV stocks fell steeply in 2022

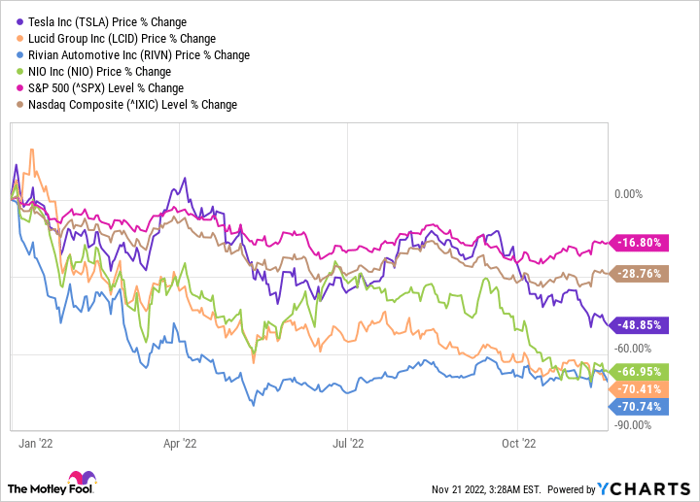

U.S. stock markets have corrected significantly so far this year. The S&P 500 is down 17%, while the Nasdaq Composite has fallen more than 28% as of this writing. Since growth stocks typically trade at high multiples, they tend to fall harder during market corrections. This has certainly been true in 2022.

While Tesla (NASDAQ: TSLA) stock has fallen 49%, Lucid (NASDAQ: LCID), Rivian (NASDAQ: RIVN), and Nio (NYSE: NIO) have fallen more than 60% year to date. And all four stocks have fallen far more from their all-time high prices; while Tesla stock has dropped more than 55% from its peak, the others are down more than 80% from theirs.

Is the correction justified, or is there a buying opportunity?

In early 2021, the valuations of EV stocks went through the roof thanks to the hype surrounding electric vehicles. As the broader markets corrected, EV stocks fell, too. And supply chain challenges have hurt the production of EV companies while raising their costs. But has the recent decline finally made these stocks attractive?

For sure, the EV story is just getting started. All these companies have a long growth runway as the transition from internal-combustion vehicles to EVs unfolds. While it is broadly accepted that this transition is inevitable, what isn't as clear is which players will thrive in the long run.

Tesla continues to post solid performance

Tesla's stock seems to have fallen to an attractive level. While it is difficult to determine whether it'll fall further in the short term, the stock is intriguing for several reasons. To begin with, its valuation is far more sensible than it has been in the past.

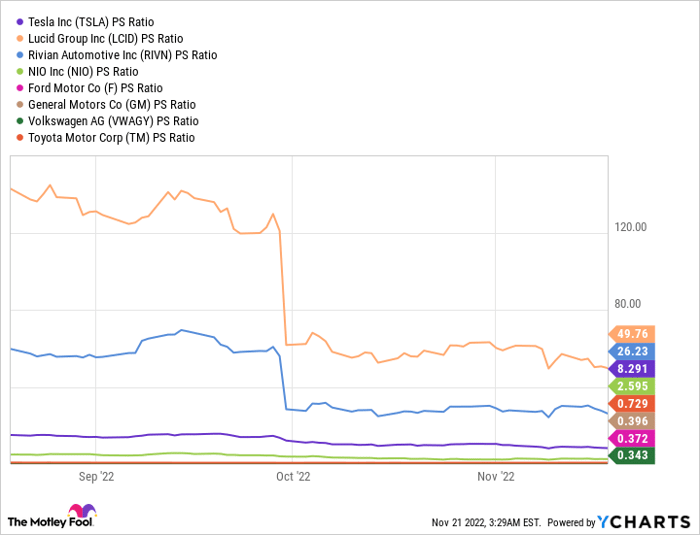

TSLA PS Ratio data by YCharts.

Tesla's price-to-sales ratio has fallen to 8.3 from around 30 in January 2021. Although it still looks high compared to traditional automakers, that's because Tesla is still growing fast. The company's revenue increased 56% year over year in the third quarter. And that isn't a one-off quarter; its growth over the years is impressive.

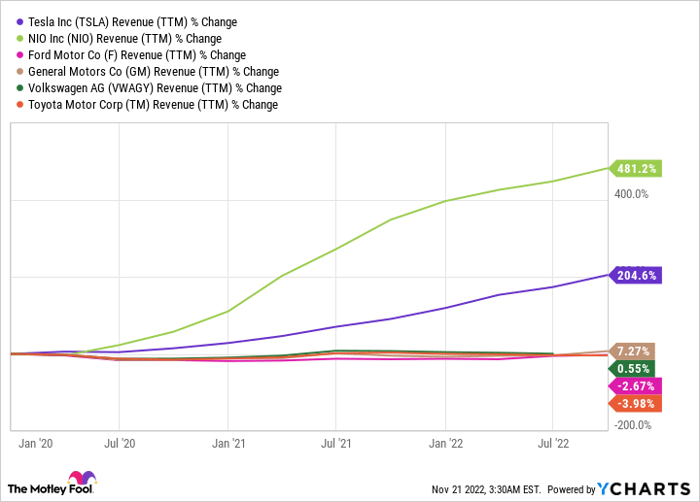

TSLA Revenue (TTM) data by YCharts. TTM = traling 12 months..

The above chart compares Tesla's revenue growth over the last three years with that of traditional automakers.

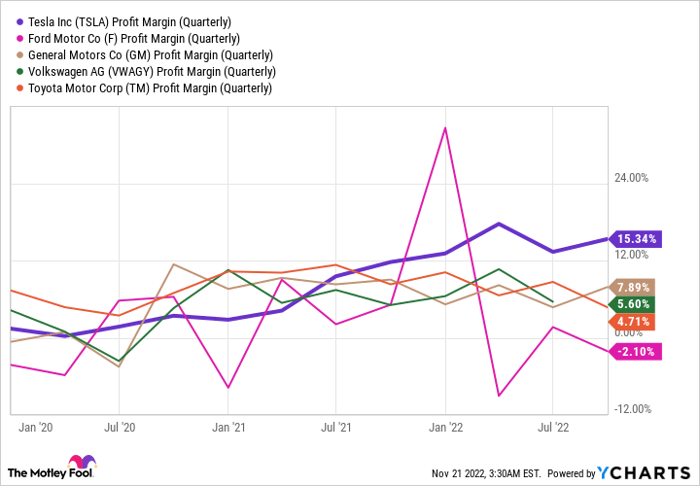

At the same time, its margins remain impressive.

TSLA profit margin (quarterly); data by YCharts.

Overall, Tesla appears to be on a solid footing to keep posting sustained growth in the coming years.

Nio's growth looks impressive

Chinese EV maker Nio expects substantial growth in vehicle deliveries in the fourth quarter and in 2023. Although the company is still incurring losses, it is increasing revenue rapidly, as the chart above shows. Its upcoming models and expansion plans in Europe can be key drivers in the coming years.

Lucid and Rivian look promising

Lucid and Rivian are still at very early stages of their growth compared to Tesla, but both look promising. Lucid managed to establish itself as a serious player by delivering the longest range for its first model, the Lucid Air. The company, which started deliveries at the end of October 2021, has delivered roughly 2,500 cars in a year. It targets producing 6,000 to 7,000 cars in 2022.

After launching the Sapphire, Pure, and Grand Touring variations of the Lucid Air, the company now plans to open registrations for its first SUV, the Gravity, in early 2023. Its focus on the less-tapped Saudi market could help it drive significant growth.

After starting deliveries in September 2021, Rivian has already produced more than 15,000 vehicles. And it has a backlog of more than 114,000 units of its R1, including both SUVs and pickup trucks. It has an attractive order backlog, too: 100,000 delivery vans from Amazon. What's more, it has enough cash to fund its operations through 2025.

Both Lucid and Rivian are at early stages of their growth and are incurring losses. As young EV makers, they are more affected by the supply chain issues that the industry is facing than are the established players. Both companies look promising, but investors should note that these stocks are riskier compared to those of legacy automakers or Tesla.

But they have corrected drastically and, if successful, could generate windfall returns for long-term investors. In short, all four stocks look like attractive buys for 2023.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.