This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Some of the most critical questions any investor can ask before buying a stock center on its profit margin. As a rough rule of thumb, it's usually a good idea to look at stocks with rising margins and avoid those with margins in decline.

Let's find out why by looking at two market-beating stocks. Illinois Tool Works (NYSE: ITW) and Honeywell International (NASDAQ: HON) have increased more than 250% over the last decade compared to the S&P 500's increase of 183%.

Two key benefits of rising margins

The first benefit is somewhat obvious, but the second might come as a surprise. They both relate to margins and their impact on valuation.

- Rising profit margins, provided revenue keeps growing, mean more profit, which usually means a higher valuation.

- Rising profit margins encourage investors to pay a higher multiple for the stock, leading to higher valuations.

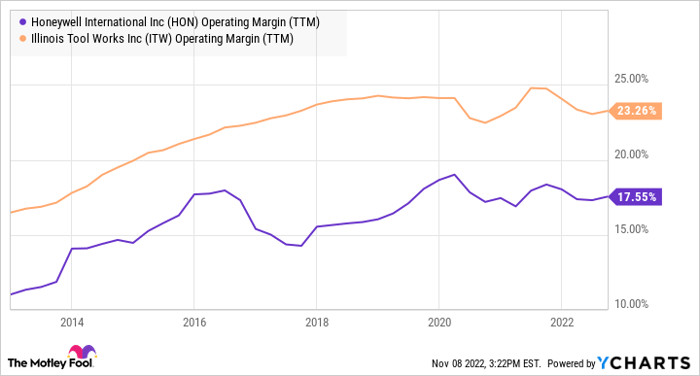

These arguments are demonstrated in the charts below. Here's how the two companies have raised operating profit margins over the last decade.

Data by YCharts.

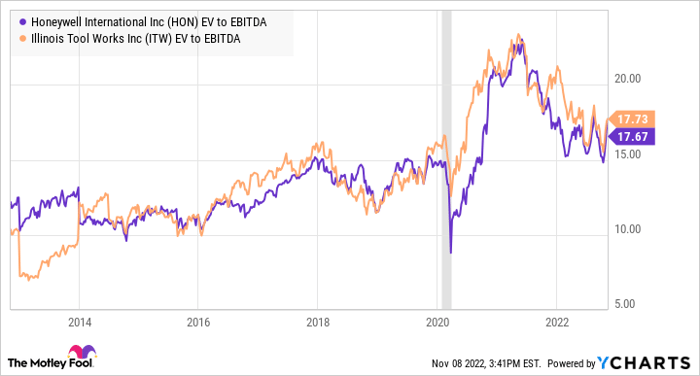

Here's a look at how the market has demonstrated a willingness to pay higher multiples for the stocks. The multiple used here is enterprise value (market cap plus net debt) to earnings before interest, taxation, depreciation, and amortization (EBITDA). It's a commonly used valuation method that factors in debt.

Data by YCharts

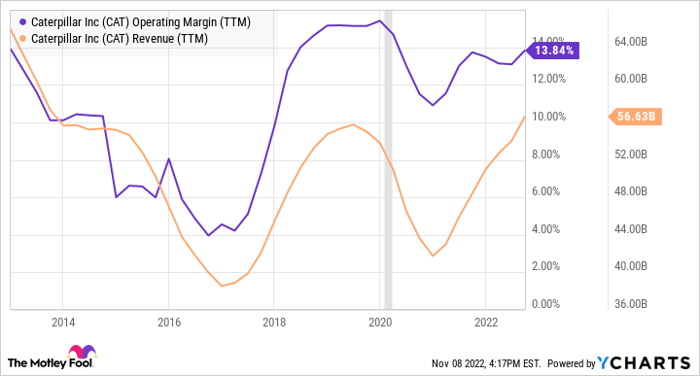

However, it's not a hard and fast rule. For example, highly cyclical stocks like Caterpillar (NYSE: CAT) can have wildly fluctuating revenue and margins due to the vagaries of the construction, mining, and energy markets and copper. Still, the case for buying Caterpillar's stock is based on rising profit margins. Caterpillar's margins will hopefully trend upwards over time while fluctuating on the way. In Caterpillar's case, it primarily comes down to management's efforts to expand its higher-margin services revenue.

Data by YCharts..

Illinois Tool Works and Honeywell

The two companies took different routes to raise their profit margins. Since CEO Scott Santi took over in 2012, Illinois Tool Works has been driven to improve margins through the execution of its enterprise strategy. Its initiatives within the strategy emphasize focusing on markets and product lines where it has an advantage, and practicing its "80/20 front-to-back" practices.

The latter involves a customer-led focus on the 20% of its customers that generates 80% of its revenue and refining its competitive strategy based on feedback from customers. It may sound like simple blocking and tackling, but it's been good enough to help improve the operating profit margin from 15.9% in 2012 to to around 24% in 2022.

For Honeywell, it's more a case of investing in growth businesses and "breakthrough" initiatives that give it differentiated products with real pricing power. Examples include quantum computing, airplane Wi-Fi, warehouse automation, building controls, IoT sensors, systems for air taxis and cargo drones, and a host of sustainable technology solutions. In a year of high inflation, it's imperative to be able to raise prices to offset costs and grow margins. Honeywell is doing just that in 2022, with its prices up 9% year to date , and the company is set to raise its profit margin again this year.

Buy stocks with companies that have rising margins

The examples of Honeywell and Illinois Tool Works highlight the importance of buying stocks with rising margins and a plan or business model to raise margins.

Similarly, stocks that aren't raising margins (with the notable caveat of cyclical stocks and very early growth stocks) are worth avoiding. It's the key metric to look for when appraising a stock.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.