The Woolworths Group Ltd (ASX: WOW) share price continues its descent into chaos today and currently trades in the red.

At the time of writing, the retail conglomerate is swapping hands 2.97% down at $32.39, despite no market-sensitive information.

Noteworthy however is the company's annual general meeting (AGM) address released today, covering the group's AGM presentation.

Woolworths sees murky waters ahead

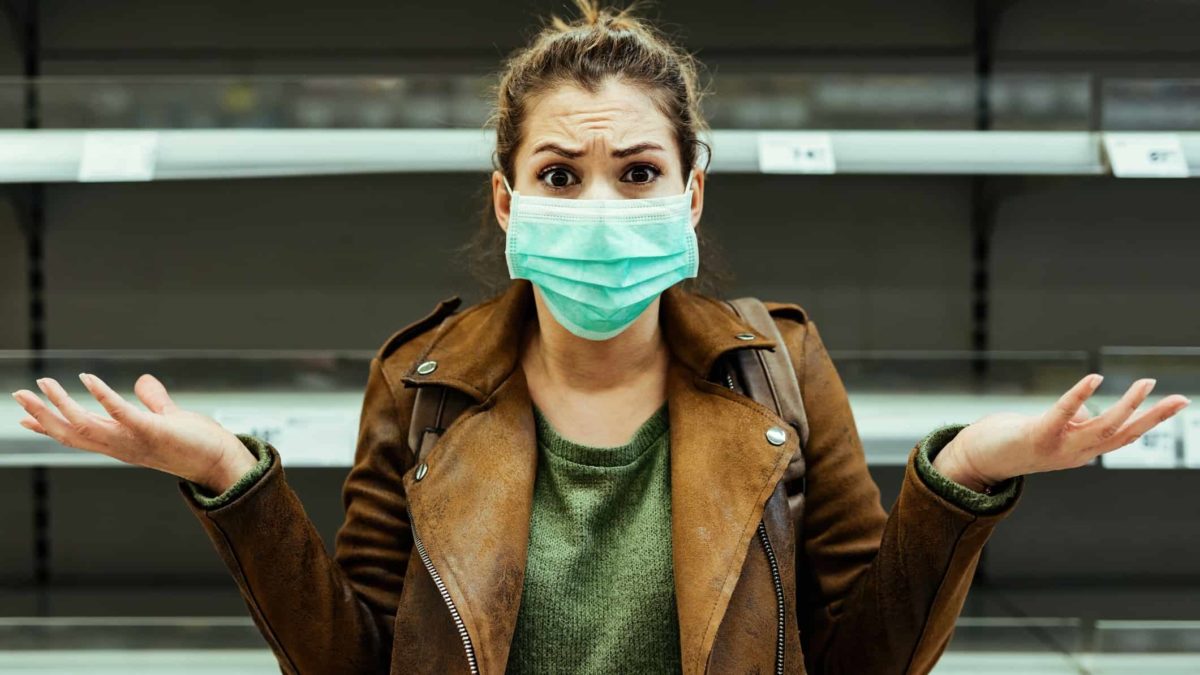

It was a busy year for the company having to endure the confines of COVID-19 and subsequent recipe of higher rates and sticky inflation.

The group saw an average of 19 million customers visit its digital platforms over FY22. Whereas the number of 'Everyday Rewards' members came in at 13.7 million.

In the first eight weeks of FY23, the group says that Australian Food sales was down 50 basis points. Whereas its Big W franchise has grown revenue 30% year on year.

New Zealand sales on the other hand are down 1% at this point into the new financial year, the company says.

As such, outgoing chairman Gordon Cairns, in his last post as chair, said there were murky waters ahead for Aussie businesses.

As we move further into F23, we expect the operating environment to remain challenging but we are extremely focused on returning to consistently good customer and team experiences.

We are very conscious of the challenges of inflation and cost-of-living pressures for our customers. We know value remains more important than ever and we need to make sure all of our customers in Australia and New Zealand get their Woolies worth in the upcoming festive season and in the year ahead.

Another point to mention is the company's MyDeal segment, which saw its customer relationship management (CRM) system compromised last week. Cairns explained:

Unfortunately, a little over a week ago we were informed that MyDeal's Customer Relationship Management system had been compromised, impacting 2.2 million MyDeal customers…

Importantly, no payment, drivers licence or password details were accessed. There was also no compromise of any Woolworths Group platform as the MyDeal data is on a completely separate platform.

We took swift action once notified of the breach… and importantly, shut down opportunities for further unauthorised access.

Woolworths share price snapshot

Meanwhile, Woolworths shares have struggled this year. They have failed to break through the $40 barrier on two occasions in the past 12 months, as seen in the chart below. The Woolies share price is down 20% in that time.

Since its last attempt on 17 August, the company's share price has sold off hard. It now trades firmly at 52-week lows.

Still, the Woolworths share price trades at 26.5 times earnings. At these prices it presents a trailing dividend yield of just 2.7%. Hence, the question remains, is it cheap or not?