The FBR Ltd (ASX: FBR) share price bounced 10% on Wednesday after the company came out of a self-requested trading pause to respond to speculation of a potential capital raising or imminent takeover.

According to an article published on afr.com late last night, the bricklaying robotics company has recruited investment and advisory group Jarden Australia to set up meetings with fund managers.

According to the article, the purpose of the meetings is "to talk through the milestones FBR wants to hit over the next 12 months — binding orders for its robots, US and Europe expansion, and new hardware and software".

The story speculated that this "informal roadshow" might imply that FBR is looking to boost its balance sheet with a capital raising.

Or perhaps Jarden is "angling for a defence mandate" in light of Australia's biggest brickmaker, Brickworks Limited (ASX: BKW) buying up almost 12% of FBR shares in recent times. Maybe Brickworks is thinking about a takeover bid?

The ASX announced a temporary pause in trading for FBR shares one minute before the market open.

How did FBR and its share price respond?

FBR issued a statement at noon, saying:

The Company is currently planning to undertake a Non-Deal Roadshow following the release of its audited FY22 results.

As a developing company, FBR is periodically engaged in discussions with various parties in relation to strategic and capital raising opportunities however FBR can confirm there is no formal capital raising process currently under way and it has not formally engaged with financial advisers in relation to this.

The ASX share resumed trading shortly after its statement, with the share price leaping 10% to 4.4 cents. It then retreated to close at 4.1 cents, up 2.5% on Tuesday's closing price.

Why is Brickworks interested in FBR?

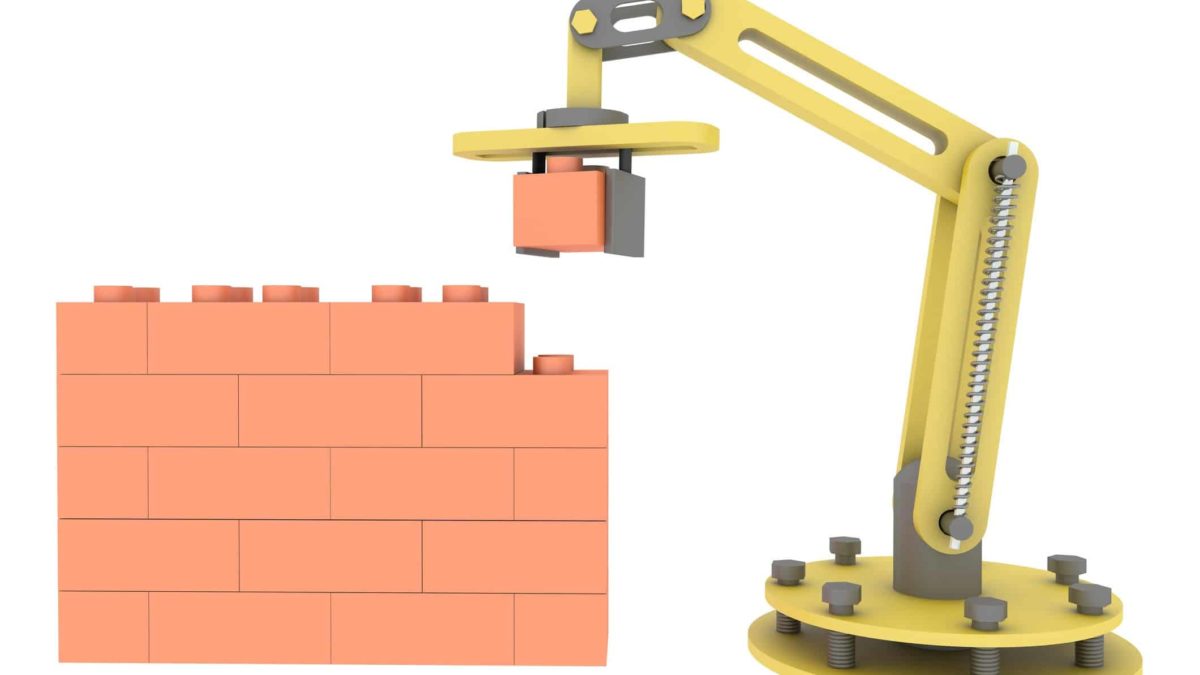

As my Foolish colleague Tristan reported recently, FBR is designing, developing, building and operating an automated and stabilised bricklaying robot called Hadrian X.

According to FBR, Hadrian X "builds structural walls faster, safer, more accurately and with less wastage than traditional manual methods".

So, you can understand why Brickworks is interested in the robot. It could potentially substantially lower costs for a company as large as them. And that would certainly come in handy right about now with global supply constraints causing major dramas and delays in construction.

At the time of Tristan's report, the speculation was that Brickworks may aim to increase its shareholding to 20% and then attempt a takeover.

On 30 August, Brickworks paid about $6.5 million for more FBR shares, increasing its holding from 7.16% to 11.94%. On 11 August, Brickworks raised its holding from 5.05% to 7.16%.

Brickworks first became a substantial holder (above 5%) back in July when it did a deal with FBR for a $1.93 million share placement.

The placement followed FBR's successful $4 million capital raising in June.