This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Warren Buffett has a lifetime of investing experience under his belt, and he's justly earned the reputation as one of history's greatest stock pickers. From 1965 through 2021, his company, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), posted an average annual return of 20.1% -- absolutely trouncing the S&P 500 index's 10.5% return across that stretch.

If you've got some spare cash just waiting to be put to use, taking some cues from the Oracle of Omaha could help you turn that money into a much larger sum. Read on for a look at two Buffett-backed stocks that look like surefire winners for long-term investors.

1. Amazon

inflation and rising interest rates have caused investors to become much more cautious about growth stocks this year. Inflationary pressures have also led to rising costs for Amazon's (NASDAQ: AMZN) e-commerce business, and this headwind has coincided with the company making some massive infrastructure and technology investments that have hurt the company's profitability.

Making matters worse, the big investments in the company's e-commerce business have coincided with weaker demand as pandemic-related conditions have eased in many parts of the world.

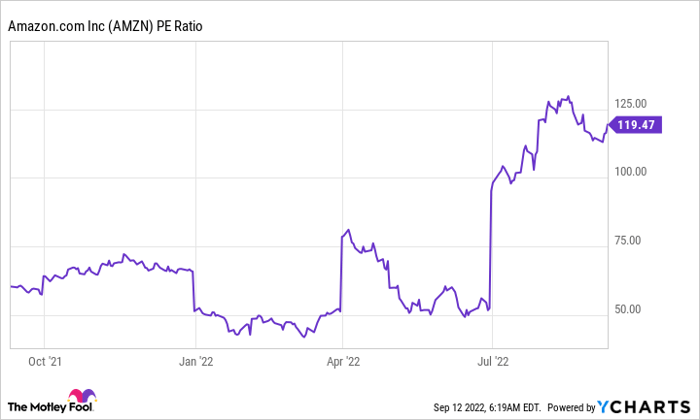

With so many negative catalysts occurring in tandem, it's not surprising that Amazon is down substantially this year. The tech giant's share price is down roughly 20% so far in 2022 and 29% from the high that it hit last year. Despite big sell-offs, the drop-off in profitability has resulted in the company's price-to-earnings (P/E) ratio skyrocketing. However, the stock still looks poised to be a big winner for long-term investors.

AMZN PE Ratio data by YCharts

Amazon's e-commerce business is going through growing pains, but the company's moves to increase its scale and infrastructure advantages will likely wind up paying off. While the online retail business accounts for the large majority of the company's revenue, it has relatively low margins; in fact, it doesn't contribute nearly as much to overall earnings as Amazon Web Services (AWS), the company's cloud infrastructure business -- and that's even when conditions are more favorable.

But warehouse and delivery automation stands to make the e-commerce business much more profitable over the long haul, and the trend could prove very rewarding for patient shareholders.

In the meantime, investors can feel confident knowing that AWS is on track to continue serving up profitable growth. The segment posted 33% year-over-year sales growth and a 29% operating income margin in the second quarter, and the long-term demand outlook for cloud infrastructure services remains incredibly favorable.

With leading positions in two promising industries and a fantastic track record when it comes to innovation and execution, Amazon is built for success.

2. Berkshire Hathaway

Berkshire has scored big wins this year by investing in energy company Occidental Petroleum and video game publisher Activision Blizzard, Inc.(NASDAQ: ATVI), which is on track to be acquired by Microsoft Corporation (NASDAQ: MSFT). Buffett's investment conglomerate has also outperformed the market in 2022 thanks to its value-oriented approach and focus on backing high-quality businesses.

Apple, Bank of America, Coca-Cola, Chevron, and American Express stand as the investment conglomerate's five largest stock holdings, and investing in Berkshire Hathaway will give your portfolio exposure to these stocks, as well as the company's fully owned insurance and energy businesses and other subsidiaries.

The company also has a massive cash pile to work with, too. As of its last filing, Berkshire had $105.4 billion in cash, and keeping a lot of money on the sidelines has proven to be a smart move due to turbulent trading for stocks this year. With the S&P 500 index down roughly 15% this year and the Nasdaq Composite index down roughly 25%, Buffett now has opportunities to go deal hunting for stocks and potential acquisitions.

News that Berkshire has invested in a stock often sends that company's share price higher, and so owning a stake in the investment conglomerate gives you exposure to those companies before news of Buffett's latest buys hits the wires. Berkshire's market-crushing track record speaks to the quality of the management team, which includes Buffett, Vice Chairman Charlie Munger, and some younger blood who have come on board too -- all working to grow your wealth.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.