This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

From time to time, you might read about the S&P 500 Dividend Aristocrats. These companies are S&P 500 index members that have paid and raised a dividend for at least 25 consecutive years.

Those looking for total returns might scoff at dividend stocks as mature companies that have left their best growth days in the rearview mirror. But consider that the Dividend Aristocrats have collectively outperformed the S&P 500 index by an average of 0.74% annually, which creates a significant margin over the course of decades.

What's the secret to their success and what can that mean for your portfolio? Here is why every investor should at least consider adding some Aristocrats to their long-term investment strategy.

The anatomy of a dividend

Most investors know what a dividend is: Companies that have available cash will sometimes share it with shareholders. But many investors skip over the anatomy of a dividend and how it impacts a business.

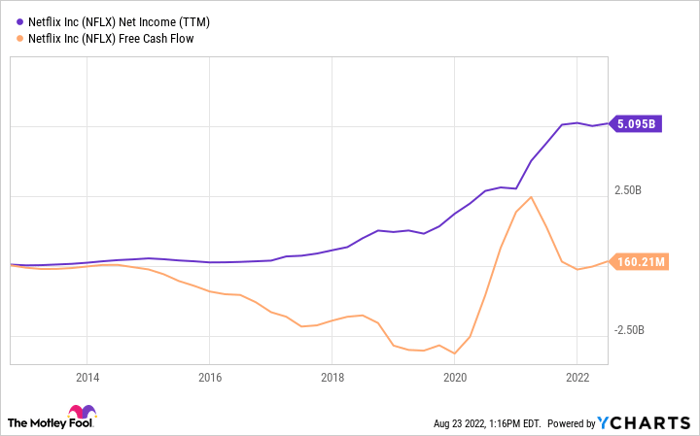

For example, a dividend is a cash expense. Accounting rules can twist a lot of the financial jargon and metrics you see in a company's financials. A company like Netflix can show a bottom-line profit but generate little free cash flow simultaneously because accounting rules can affect how companies report their earnings.

NFLX net income (TTM). Data by YCharts. TTM = trailing 12 months.

A company can only pay a dividend in cash; it can borrow money to pay a dividend, but that's a losing game that never lasts long. A business that can not only pay you part of its cash profits but also keep increasing its annual payout can only do so if it's growing over the long term. You can't fake it.

Successful investing can be as simple as buying quality businesses and letting them do their magic over time. A Dividend Aristocrat often fits that bill simply because of what is entailed with paying and raising a cash expense like a dividend.

An additional level of compounding

A steadily growing business will generate capital gains as earnings grow over time, but what you can do with dividends propels Aristocrats as investments. Dividends are essential to investment returns; they made up 31% of total returns from the S&P 500 from 1926 to 2021.

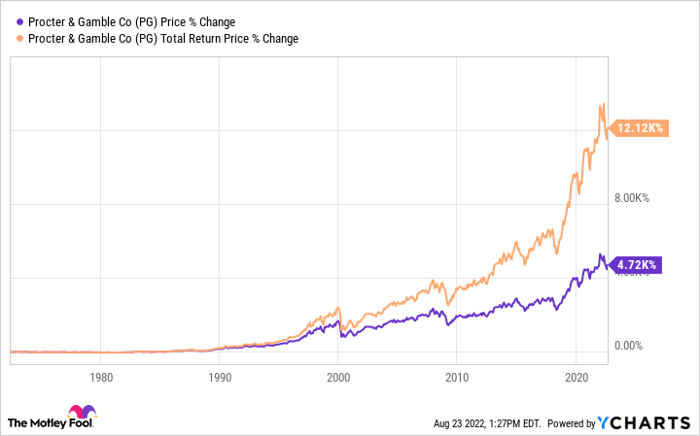

You can also reinvest dividends, taking the cash and buying more shares. Those new shares don't cost you any out-of-pocket money beyond your initial investment, and will pay dividends of their own, creating a compounding effect.

This can have a considerable impact on your total investment returns over time. Consider a stock like Procter & Gamble, a Dividend King with 66 consecutive years of dividend increases. Investors have earned 4,720% in lifetime returns from capital appreciation since the early 1970s. That's great, but that would have nearly tripled to 12,120% by reinvesting the dividends to take advantage of compounding!

You don't need home runs to win the game

Ultimately, you don't need to find the next Amazon to have a lucrative investment journey. Derek Jeter is one of baseball's greatest players because he could consistently hit the ball year in and year out, even if it didn't often go out of the park.

The same applies to investing. A Dividend Aristocrat probably won't make you rich overnight, but you can become wealthy by buying and holding Aristocrats as part of a diversified portfolio with a long-term outlook.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.