The BrainChip Holdings Ltd (ASX: BRN) share price closed the session down 6.38% on Monday on no news from the company.

Shares in the artificial intelligence technology developer finished at 88 cents each today.

Despite posting a nearly 530% increase in revenue in its H1 FY22 results last week, investors haven't been keen to nibble at the company's current share price.

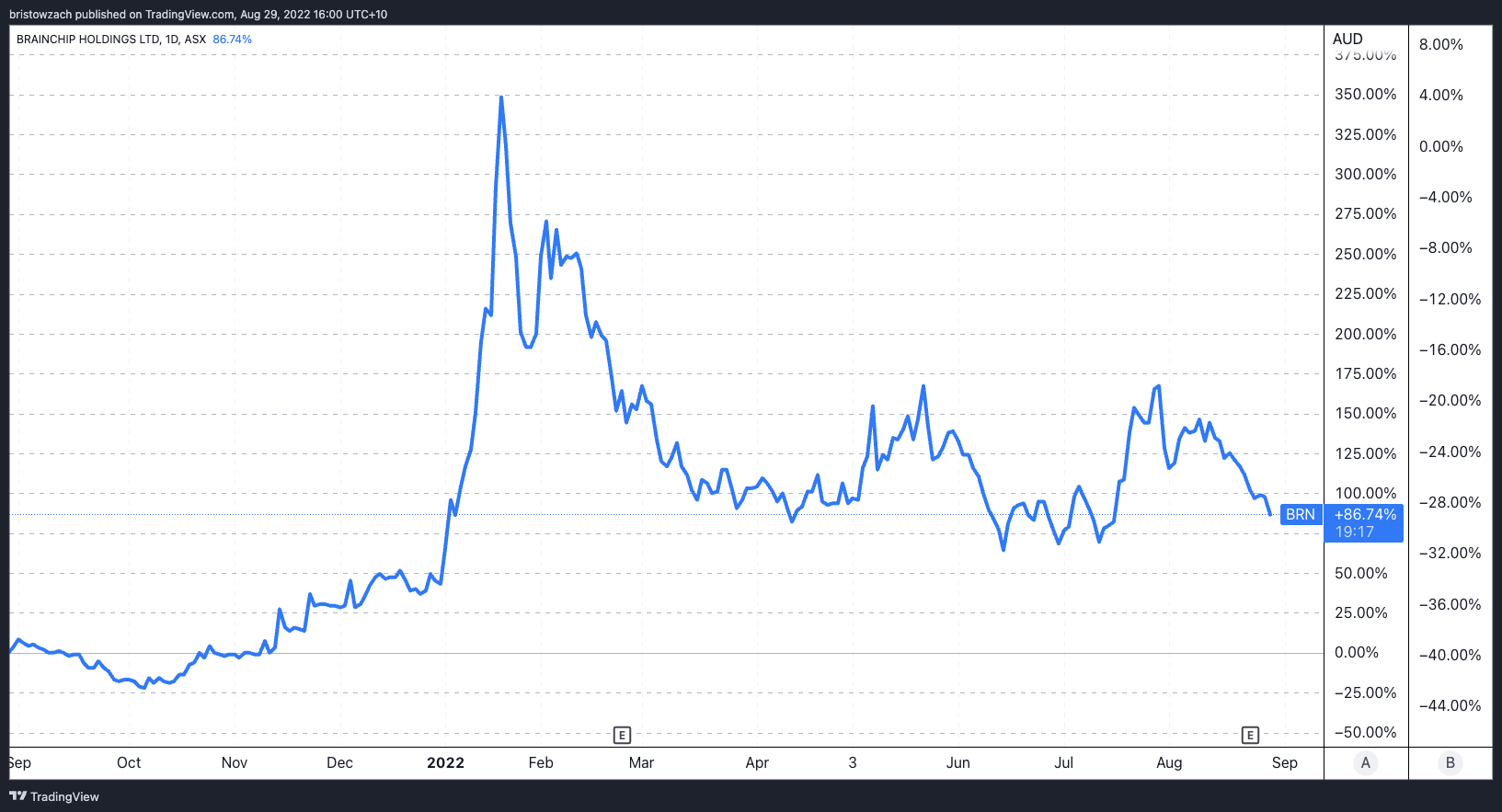

In fact, as seen on the chart below, BrainChip has traded sideways for a good portion of 2022.

What's up with the BrainChip share price?

Revenue for the six months to 30 June 2022 came in at A$7 million, up 529% year on year.

However, further down the balance sheet, it wasn't so rosy. Operating losses were down just 1% to A$12.35 million whereas the company still printed a loss per share of 66 cents.

As reported by colleague Matthew Farley at the time, "[a]nother item that grew considerably [in H1 FY22] was its share-based payment expenses, swelling 128% to AU$5.27 million".

The company attributed the rise to equity issued to directors and employees.

The recent drop for BrainChip has occurred in lockstep with a pullback in the S&P/ASX All Technology Index (ASX: XTX), down nearly 3% in the past month.

Zooming out, however, BrainChip shares remain buoyant, up 29% year to date and 81% higher over the past 12 months.

Also, when looking at the chart above, the downside for BrainChip is hardly out of sync with what the share has been displaying over the past eight or nine months.

Technology shares have caught a bid in recent months with more stable yields on government bonds, yet remain volatile.

With talks of a global recession resurfacing, what this means for the BrainChip share price looking ahead remains to be seen.