This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

In July, inflation slowed from 9.1% to 8.5%, which offered some badly needed relief to the American consumer. Additionally, the labor market added over 500,000 jobs while maintaining an unemployment rate of just 3.5%.

If a recession is underway, someone forgot to tell the economy.

With the recent positive news, you might be wondering: Is now a good time to buy stocks? The truth is, if you're a long-term investor, it's always a good time to put money in the stock market. And while I personally think this is a great entry point for investors, there are a few things you should consider before investing your money.

Do you have an emergency fund?

An emergency fundis a cash reserve you can fall back on in case of unforeseen circumstances. Financial advisors typically recommend you hold enough cash to cover three to six months of expenses before investing, but it really depends on your personal risk tolerance.

If you need eight months of expenses saved up in order to sleep at night, then that's what you should have in your emergency fund before you put your capital to work.

Will you need the money in the next three to five years?

Another thing to consider before investing your hard-earned money is when you'll need that cash again. Ideally, you shouldn't invest money that you anticipate needing in the next three to five years, preferably longer.

Obviously, you can't predict the future (hence the emergency fund), but if for example, you know you are planning to buy a house or sending your kids to college in the next few years, you should not invest that money.

The market is unpredictable, so investing capital you will need in the near future can be a recipe for disaster.

Do you have high-interest debt?

Investing your savings while simultaneously paying off high-interest debt such as credit card debt is sort of like swimming in a riptide. It's a whole lot of effort for very little progress.

If the S&P 500 returns on average 10% annually, but the interest on your credit card balance is 18%, it makes more financial sense to pay off your debt first instead of buying stocks.

This is not a universal rule, but if the interest rate on your debt is higher than your anticipated rate of return, you should pay off the debt before investing.

Have you educated yourself about investing?

The last thing to consider is if you've spent the time to understand the stock market before diving in. Fear of missing out (FOMO) can often cause stock market newcomers to rush into positions before they really understand the mechanics of the market and companies they're investing in.

Horror stories of beginners accumulating huge margin debts or losing years of savings due to a lack of knowledge are all too common, so you want to be sure you understand the basics before buying your first shares.

Fortunately, there are investment vehicles such as low-cost exchange-traded fund (ETF)s, which require less research to understand. The beauty of the ETFs is a complete amateur can go from knowing nothing about investing to owning a piece of the best companies in the U.S. by buying an ETF such as the Vanguard 500 Index Fund ETF, all in a span of 30 minutes or so.

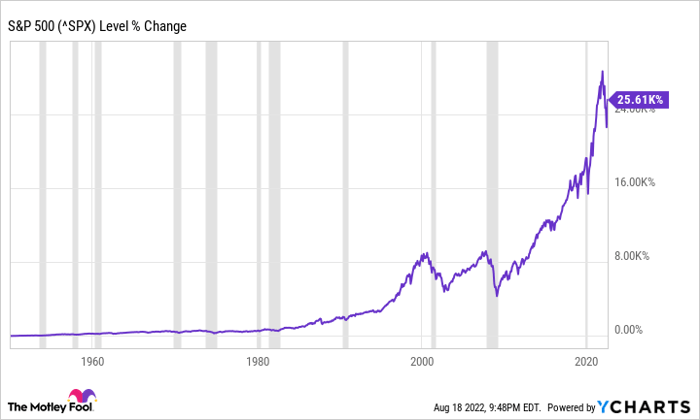

And despite numerous recessions, natural disasters, and the endless pessimism from the financial media, the stock market has continued to reward patient long-term investors:

Data by YCharts.

The bigger risk is actually not investing.

According to a study from Bank of America, the return of the S&P 500 between 1930 and 2020 was nearly 18,000%. But if you removed the 10 best trading days from each decade in that period, the return falls to just 28%. That means investors are better off holding on long term rather than jumping in and out of the market.

Net buyers of stocks are the ultimate winners

The undefeated stock market strategy is to simply be a net buyer of great companies regardless of market conditions.

Don't believe me? Just ask the greatest investor of all time, Warren Buffett.

At a Berkshire Hathaway (NYSE: BRK-B) annual meeting in April, Buffett said:

I don't think we've [referring to Vice Chairman Charlie Munger] ever made a decision where either one of us has either said or been thinking: 'We should buy or sell based on what the market is going to do.'

Buffett understands that if you hold great companies long enough, the risk declines over time. According to MSCI, the probability of positive returns on an investment in the S&P 500 that's held for at least 10 years is about 95%.

Whether you plan to buy a basket of diversified stocks or purely low-cost index funds, now remains a great opportunity to invest in the market to build toward financial independence.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.